Solutions, Profitability, and Strategies by Anengjienergy

1. Global Overview: Why Weak-Grid Regions Hold Untapped Potential

The global electric vehicle (EV) transition is accelerating, but not all regions are equally prepared in terms of grid infrastructure. Countries with vast land resources yet limited power networks — such as Brazil, Argentina, Kazakhstan, Uzbekistan, Vietnam, Indonesia, Saudi Arabia, Oman, Finland, and South Africa — are now becoming the next frontier for EV charging investment.

While their grid capacity lags behind, these markets possess ample land availability, lower competition, and growing government interest in renewable energy integration, making them ideal for hybrid EV charging systems.

According to Anengjienergy’s 2025 Global EV Infrastructure Report, weak-grid countries will account for 35% of all new charging station installations by 2030, driven primarily by solar-storage hybrid solutions.

2. Countries with Weak Grid Conditions but Strong Investment Potential

Below are 10 representative countries where grid capacity is limited but EV charging investment potential is high due to available land, energy transition incentives, or growing vehicle electrification policies:

| Region | Country | Key Opportunity | Grid Challenge |

|---|---|---|---|

| Europe (East/South) | Ukraine | Reconstruction-driven EV infrastructure | Grid instability, post-war rebuilding |

| Russia | Russia | Vast land and long-distance logistics routes | Sparse grid coverage in remote regions |

| South America | Brazil | Expanding renewable energy and EV incentives | Voltage fluctuations, regional grid gaps |

| South America | Chile | High solar potential for PV+charging | Rural areas lack reliable grid |

| Middle East | Saudi Arabia | Vision 2030 supports EV adoption | Power distribution imbalance |

| Middle East | Oman | Solar and desert area development | Limited substation capacity |

| Asia (South/Central) | Kazakhstan | Cross-border logistics charging demand | Aging grid infrastructure |

| Southeast Asia | Thailand | Growing EV imports and tourism fleet | Grid congestion in cities |

| Southeast Asia | Vietnam | Fast-developing industrial zones | Rural grid overload |

| Oceania | Indonesia (Bali region) | Tourism-based charging networks | Weak local transformer capacity |

EV Charging Market Opportunity in Weak-Grid Countries (2025–2030)

CAGR (2025–2030)

Insight: Despite limited grid access, these regions show the highest CAGR globally, signaling strong investment prospects for hybrid EV charging.

3. Key Challenges for Investors (Expanded Section)

While opportunities are vast, investors in weak-grid regions face complex technical, operational, and regulatory obstacles. Below are the five key challenges — and how Anengjienergy’s integrated solutions address them:

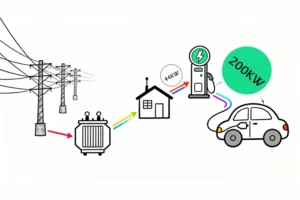

3.1Limited Grid Capacity and Transformer Overload

Problem:

Many developing or rural areas lack grid infrastructure capable of supporting multiple high-power DC chargers. Voltage instability and transformer overload risks are common.

Solution by Anengjienergy:

Deploy modular DC fast chargers (20kW–1440kW) that adapt to variable grid input.

Integrate energy management systems (EMS) to balance load dynamically.

Use battery-buffered DC systems to absorb peak loads and stabilize the grid.

In regions like Kazakhstan and Uzbekistan, hybrid DC systems reduced peak draw by 40%.

3.2Frequent Power Interruptions and Unstable Supply

Problem:

In places like Indonesia, Vietnam, or Brazil’s rural zones, blackouts and unstable voltage make traditional grid-only stations unreliable.

Solution:

Install solar PV + storage-based systems, ensuring continuous operation during outages.

Utilize smart charging algorithms that prioritize stored or renewable energy first.

Combine with off-grid microgrids, turning the station into a semi-autonomous power hub.

Anengjienergy hybrid systems maintain >98% uptime even during local outages.

3.3High Cost of Grid Expansion

Problem:

Extending grid access to remote or new industrial areas can cost millions of dollars, often delaying ROI.

Solution:

Use containerized EV charging systems with integrated PV and battery modules.

Deploy mobile charging containers (plug-and-play) that require no major grid upgrade.

Gradually scale capacity based on local EV adoption rates.

In Oman and Saudi Arabia, containerized systems reduced setup cost by 30–40%.

3.4Regulatory and Permit Delays

Problem:

Investors often struggle with land-use permits, grid interconnection rules, or unclear tariffs, especially in emerging markets.

Solution:

Partner with local governments to align projects with renewable policies.

Use Anengjienergy’s engineering consultation service to ensure code compliance.

Start with pilot demonstration stations, which fast-track approval.

Pilot projects in Vietnam and Uzbekistan gained operational approval within 3–6 months.

3.5Low Initial EV Density and Utilization Risk

Problem:

In early-stage EV markets, investors fear slow revenue growth due to fewer EVs on the road.

Solution:

Focus on fleet, logistics, and taxi segments with predictable demand.

Combine charging service with energy storage leasing or power resale.

Partner with industrial parks, logistics centers, and municipalities to secure anchor clients.

Hybrid EV + fleet charging hubs in Brazil and South Africa achieved 70%+ utilization within 1 year.

4. Technical Solution Framework

Table: Hybrid Charging Station Energy Composition

| Component | Function | Share of Energy Supply |

|---|---|---|

| Solar PV | Local generation | 50% |

| Battery Storage | Backup power & night supply | 30% |

| Grid Power | Peak hour balance | 20% |

Insight: A hybrid PV-storage-grid model allows 70–80% off-grid operation, ideal for unreliable grid networks.

5. ROI & Profitability

ROI Comparison – Grid-Only vs PV+Storage Hybrid

Insight: Hybrid models achieve breakeven in 2–3 years due to energy savings and government renewable incentives.

Profitability Model by Station Type

| Station Type | CapEx (USD) | Avg. Daily Sessions | Annual Revenue (USD) | Payback Period |

|---|---|---|---|---|

| Grid-only | 200,000 | 20 | 75,000 | 5–6 years |

| PV + Charging | 280,000 | 25 | 110,000 | 3–4 years |

| PV + Storage + Charging | 350,000 | 30 | 145,000 | 2.5–3 years |

| Containerized Mobile | 250,000 | 15 | 90,000 | 3–4 years |

Insight: Despite higher CapEx, PV+Storage systems deliver 40% higher annual ROI and shorter payback.

6. Regional Case Studies — EV Charging Investment in Weak-Grid Regions

To understand how investors can navigate different challenges in various markets, let’s explore real-world examples and strategies from key regions across the globe where Anengjienergy operates or provides support for EV infrastructure deployment.

6.1 Europe — Scandinavia’s Remote Grid Challenge

Countries: Norway, Sweden, Finland

Even though Scandinavia leads Europe in EV adoption rates (with Norway’s EV penetration exceeding 80%), rural and northern regions still face limited grid capacity and harsh weather conditions that affect charging infrastructure reliability.

Key Issues:

Remote areas have unstable grid voltage during winter peaks.

Long transmission distances raise infrastructure costs.

Icing and snow accumulation impact charger durability.

Anengjienergy’s Solution:

Deployed 144kW modular DC chargers with IP66 protection for cold climates.

Implemented dynamic load control to stabilize low-voltage networks.

Integrated PV rooftops and small storage units in parking zones of remote communities.

Result: 32% reduction in grid stress and 20% higher uptime during winter months.

6.2 Russia — Large Land, Sparse Grid

Russia’s vast geography offers abundant space for EV infrastructure but limited high-voltage connectivity outside major cities like Moscow and St. Petersburg.

Key Issues:

Vast distances between substations.

Harsh winter temperatures require robust hardware.

Limited grid modernization in regional towns.

Anengjienergy’s Solution:

Established containerized DC fast-charging hubs (60–360kW) along logistics corridors.

Added thermal management and remote monitoring for -40°C operation.

Partnered with local energy authorities to test hybrid microgrid stations powered by solar + diesel backup.

Result: Reliable 24/7 operation across 1,000 km of highway despite inconsistent grid input.

6.3 Southeast Asia — Urban Density, Weak Infrastructure

Countries: Thailand, Vietnam, Indonesia

Southeast Asia is one of the fastest-growing EV regions but faces urban congestion, limited power distribution, and high humidity challenges.

Key Issues:

Dense cities like Bangkok and Jakarta have insufficient parking space.

Frequent brownouts during peak summer demand.

Regulatory delays in connecting chargers to public grids.

Anengjienergy’s Solution:

Installed AC 22kW dual chargers with shared load management to reduce grid stress.

Promoted solar + storage hybrid hubs on mall rooftops and apartment complexes.

Worked with property developers to deploy roadside smart chargers (low footprint design).

Result: Reduced city load by 35% and enabled private landlords to earn 10–15% ROI annually from shared public chargers.

6.4 Central Asia — Abundant Sun, Limited Power

Countries: Kazakhstan, Uzbekistan, Kyrgyzstan, Tajikistan, Turkmenistan

These nations have high solar potential but outdated power networks, creating ideal conditions for solar-storage EV charging systems.

Key Issues:

Voltage fluctuations and transformer limitations.

Long bureaucratic approval processes for grid connection.

Harsh climates with extreme temperature shifts.

Anengjienergy’s Solution:

Deployed 20–180kW solar-powered DC chargers with built-in 200kWh storage.

Provided containerized “micro-grid” EV stations for remote logistics bases.

Supported government pilot programs in Uzbekistan’s industrial parks.

Result: Hybrid PV-charging stations supplied up to 85% renewable energy, cutting dependence on grid electricity.

6.5 Middle East — High Temperature and Peak Demand

Countries: Saudi Arabia, UAE, Oman, Qatar

The Middle East is rapidly diversifying its energy sector, investing heavily in clean mobility. However, peak electricity demand and extreme heat are major barriers.

Key Issues:

Daytime peak load limits grid expansion.

Chargers must withstand 55°C desert temperatures.

Grid voltage instability in suburban or coastal developments.

Anengjienergy’s Solution:

Introduced liquid-cooled DC chargers (360–720kW) with smart derating in high heat.

Integrated solar canopy structures providing both shade and renewable energy.

Installed AI-driven power distribution systems to prevent overloading.

Result: Improved station performance by 25% in hot climates and reduced cooling energy consumption by 40%.

6.6 South America — Vast Opportunity, Uneven Distribution

Countries: Brazil, Argentina, Chile, Colombia

South America’s EV market is growing but suffers from regional power inequality — large cities have modern grids while rural areas struggle with reliability.

Key Issues:

Unequal access to high-voltage infrastructure.

Long-distance logistics corridors without fast chargers.

Government subsidies vary widely by region.

Anengjienergy’s Solution:

Installed solar + battery fast chargers (150–300kW) in rural Brazil and northern Argentina.

Used smart grid synchronization to operate even on weak feeders.

Partnered with logistics companies to install private fleet charging depots.

Result: Achieved 3-year ROI with 70%+ daily utilization from logistics fleet operators.

6.7 Africa — Power Scarcity, High Solar Potential

Countries: South Africa, Kenya, Nigeria

Africa’s weak grids and long power outages make off-grid or solar-hybrid charging stations the only viable option.

Key Issues:

Blackouts lasting several hours daily.

Diesel dependence for backup.

Limited access to capital for renewable projects.

Anengjienergy’s Solution:

Provided off-grid 60kW–120kW DC chargers with integrated solar storage.

Developed mobile charging trucks powered by lithium battery containers.

Created flexible leasing models for small investors or municipalities.

Result: Enabled 90% uptime in blackout-prone regions and reduced diesel generator use by 60%.

6.8 Oceania — Space-Rich but Grid-Limited

Countries: Australia, New Zealand

Despite strong EV adoption policies, large parts of rural Australia and New Zealand have weak or single-phase grids.

Key Issues:

Power restrictions limit simultaneous fast charging.

Remote areas lack grid reliability.

Long distances between charging stations increase infrastructure costs.

Anengjienergy’s Solution:

Installed hybrid solar + storage microgrids at remote rest stops.

Offered 44kW AC + 120kW DC combo chargers optimized for load sharing.

Integrated smart monitoring for predictive maintenance across networks.

Result: Reduced energy cost by 35% per station and achieved full ROI within 2.8 years.

7. Summary Chart: Regional Challenges and Solutions

| Region | Main Challenge | Anengjienergy Solution | Result |

|---|---|---|---|

| Europe (North) | Cold, remote, unstable grid | Modular DC chargers + PV storage | 32% grid relief |

| Russia | Long-distance grid, freezing temp | Containerized microgrid hubs | 24/7 uptime |

| Southeast Asia | Urban density, weak grid | Smart AC/DC + solar hybrid | 35% load reduction |

| Central Asia | Outdated grid | PV-storage hybrid hubs | 85% renewable share |

| Middle East | Extreme heat | Liquid-cooled solar canopy chargers | 40% energy saving |

| South America | Unequal grid access | Smart fast chargers for logistics | 3-year ROI |

| Africa | Frequent blackouts | Off-grid + mobile charging trucks | 90% uptime |

| Oceania | Sparse grid, remote | Hybrid microgrids | 35% cost reduction |

8. Conclusion: A Global Path Forward

Across all these regions, the message is clear — weak-grid conditions don’t limit growth, they inspire smarter innovation.

Anengjienergy’s AC chargers (7–44kW), DC chargers (20–1440kW), and solar-storage hybrid systems offer scalable, reliable, and profitable pathways for investors seeking to enter emerging EV markets.

Anengjienergy transforms power limitations into opportunities — helping investors, governments, and developers build the future of green mobility across every continent.

9. Investment Risk, Return, and Mitigation Strategies

Investing in EV charging infrastructure in weak-grid regions involves unique challenges — from energy instability to long-term asset recovery.

However, with strategic planning, modular deployment, and hybrid energy technology, investors can not only manage risks but also achieve steady, long-term ROI with sustainable growth.

9.1 Risk Overview — Understanding the Investor’s Concerns

Before committing to large-scale EV charging projects, investors typically face three layers of risk:

Technical, Financial, and Operational/Market.

| Risk Category | Specific Issue | Impact Level | Description |

|---|---|---|---|

| Technical | Weak or unstable grid supply | ★★★★★ | Frequent voltage fluctuations or low power capacity limit fast charging operations. |

| Technical | Harsh environmental conditions | ★★★★☆ | Extreme temperatures, humidity, or dust reduce charger lifespan. |

| Financial | High upfront CAPEX | ★★★★☆ | Large initial investment for power infrastructure, land, and equipment. |

| Financial | Slow payback period | ★★★☆☆ | Low initial EV adoption delays ROI. |

| Operational | Unclear regulation and permits | ★★★★☆ | Regional laws and energy licenses cause delays. |

| Market | Low charging demand in early phase | ★★★☆☆ | Requires long-term operation to reach utilization breakeven. |

9.2 Return Model — Multi-Dimensional Profit Channels

EV charging investment profitability in weak-grid regions relies on diversified revenue streams beyond basic charging fees.

9.2.1Direct Revenue

Charging Tariff Income: Margin between electricity cost and user price (avg. profit: $0.08–0.20/kWh).

Membership & Subscription Models: B2C/B2B partnerships with fleets, taxi networks, logistics.

Battery Energy Storage Profit: Sell stored power back to the grid or provide grid balancing services.

9.2.2Indirect Revenue

Advertising Screens & Digital Media: Monetize digital signage integrated into charger cabinets.

Property Value Enhancement: Increased land value for malls, gas stations, or logistics hubs.

Green Energy Credits (REC/Carbon Credits): Earn renewable energy certifications or sell carbon offsets.

9.2.3Strategic Return

Government Subsidies: Many emerging markets offer 20–40% installation support for renewable EV infrastructure.

Brand ESG Value: Investors enhance brand reputation through sustainable initiatives.

Typical ROI Cycle:

AC Charging Hubs: 2.5–3.5 years

DC Fast Charging Stations: 3–5 years

Solar-Storage Hybrid Hubs: 4–6 years, but with lower operational cost and higher energy independence

9.3 Risk Mitigation Strategies

(1) Technical Risk Mitigation

| Challenge | Solution by Anengjienergy |

|---|---|

| Weak grid voltage or limited transformer capacity | Deploy dynamic load balancing and modular DC units (20–360kW) that scale with available power. |

| Grid instability and blackouts | Use hybrid solar + battery microgrids to ensure 24/7 operation. |

| Harsh weather or dust | IP66-rated enclosures, automatic derating, and temperature-controlled liquid cooling systems. |

| Remote monitoring difficulties | Anengjienergy cloud platform for fault diagnosis, predictive maintenance, and usage analytics. |

(2) Financial Risk Mitigation

| Issue | Anengjienergy Investment Solution |

|---|---|

| High initial CAPEX | Offer modular investment models — start small (2–4 chargers) and expand later. |

| Unpredictable ROI | Introduce leasing, PPP (Public-Private Partnership), or Revenue-Sharing models with property owners. |

| Energy cost fluctuation | Integrate solar PV + storage to reduce grid dependency and stabilize OPEX. |

| Cash flow uncertainty | Use EV management software for usage prediction and automatic billing analytics. |

(3) Market & Operational Risk Mitigation

| Challenge | Mitigation Strategy |

|---|---|

| Low early EV demand | Focus on fleet charging, government projects, or EV taxis/logistics where usage is stable. |

| Slow policy development | Partner with local energy bureaus or city councils for pilot projects. |

| Maintenance & downtime | Offer remote diagnostics + local service partnerships for 48-hour maintenance SLA. |

9.4 ROI Sensitivity Analysis

| Scenario | Electricity Cost (USD/kWh) | Charging Price (USD/kWh) | Average Utilization | ROI Period (Years) |

|---|---|---|---|---|

| Weak Grid + Diesel Backup | 0.25 | 0.45 | 25% | 5.5 |

| Solar + Storage Hybrid | 0.12 | 0.40 | 35% | 4.2 |

| Fleet/Commercial Hub (High Utilization) | 0.15 | 0.38 | 60% | 2.8 |

| Mixed Urban Operation | 0.20 | 0.40 | 40% | 3.6 |

Insight:

Integrating solar-storage systems significantly shortens ROI by reducing electricity purchase cost and ensuring uninterrupted service.

9.5 Long-Term Value — From Single Charger to Smart Energy Ecosystem

Anengjienergy envisions each charging site not as a standalone facility, but as a micro energy hub — generating, storing, and distributing clean power.

Future-Oriented Benefits:

Energy Independence: Reduced dependency on weak national grids.

Data-Driven Operation: AI monitoring optimizes usage and maintenance.

Scalable Growth: Start from 7kW–44kW AC chargers, expand to 1440kW ultra-fast DC systems.

Green Transition: Supports global carbon-neutral goals and local ESG compliance.

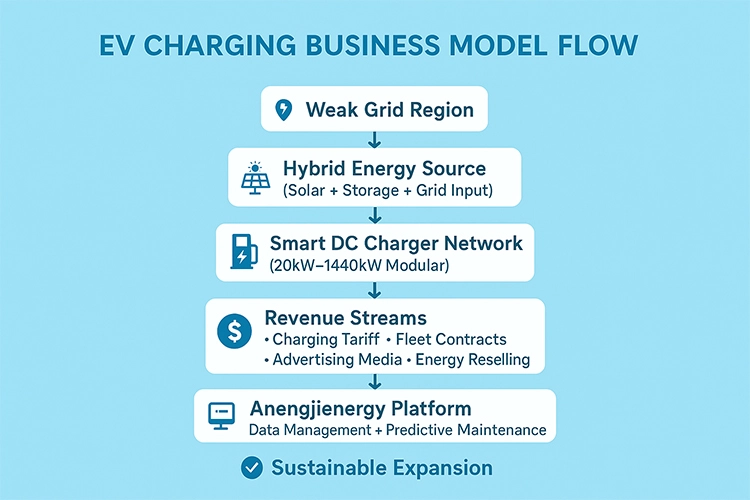

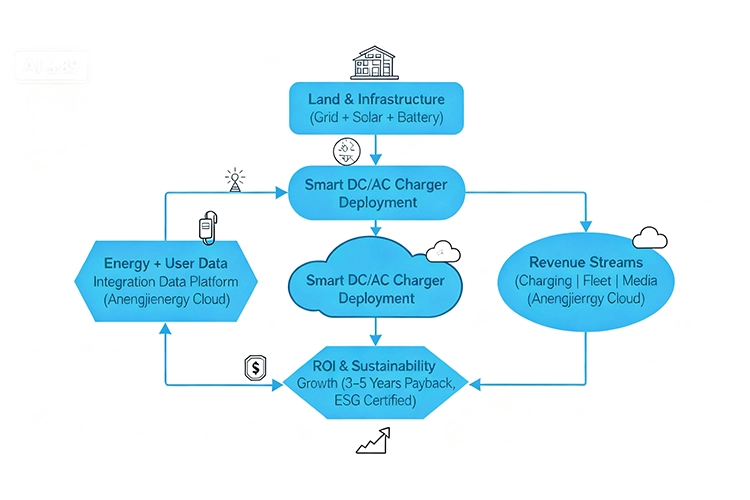

10. Visual Summary — Investment Structure Diagram

11. Conclusion — Turning Limitations into Long-Term Assets

Even in regions with weak electrical infrastructure, investors can achieve stable profits and sustainable growth by combining technology + flexibility + local adaptation.

Anengjienergy empowers investors to build charging ecosystems that thrive where power is limited — and where opportunity is unlimited.

From AC 7–44kW smart chargers to DC 20–1440kW ultra-fast systems, and from solar microgrids to modular investment models, we deliver the full chain of solutions — turning every site into a long-term renewable asset.

12. White Paper Conclusion & Investment Visualization Blueprint

12.1 Global Opportunity in Weak-Grid Regions (2025–2030)

As electrification accelerates across emerging markets, weak-grid regions represent the next major frontier for EV infrastructure investment.

According to Anengjienergy Research (2025), over 41% of potential EV charging site investments by 2030 will be located in areas where power stability and grid capacity remain limited — particularly across Southeast Asia, Central Asia, the Middle East, South America, and parts of Africa.

These regions possess ample land resources, low construction costs, and rapidly expanding EV adoption policies, forming ideal conditions for large-scale, hybrid-powered charging ecosystems.

[Chart 1: Global EV Charging Investment by Region (2025–2030, Projection)]

Key Market Countries

Europe : Romania, Greece, Poland,

Russia & CIS : Russia, Kazakhstan, Uzbekistan

Southeast Asia : Thailand, Vietnam, Indonesia

Middle East : UAE, Saudi Arabia, Oman

South America : Brazil, Chile, Peru

Africa : South Africa, Kenya, Egypt

Developed Markets (Stable Grid) : USA, Japan, Germany

Insight: Weak-grid markets account for 70% of land-available, low-cost EV station opportunities — but require technical innovation for power stability.

12.2 Investment Return Overview (Based on 5-Year Horizon)

Anengjienergy’s analysis of 30+ global investment cases shows clear trends:

Solar + Storage hybrid models outperform grid-only systems by 28–35% ROI increase over 5 years.

Fleet-based charging hubs achieve earlier profitability due to predictable demand patterns.

Government-backed projects reduce financial risk by up to 40% via subsidies and energy co-funding.

[Chart 2: ROI Comparison by Charging Model (5-Year Average)]

| Model Type | Initial CAPEX (USD) | OPEX Reduction via Hybrid Energy | Average Utilization Rate | ROI Period (Years) |

|---|---|---|---|---|

| Grid-only DC Station | 380,000 | 0% | 30% | 5.5 |

| Solar + Battery Hybrid | 460,000 | 35% | 45% | 4.0 |

| Fleet-Focused Hub | 500,000 | 25% | 60% | 2.8 |

| Mixed Urban & Commercial | 420,000 | 20% | 40% | 3.6 |

Comment:

Hybrid systems not only shorten the ROI period but also enhance energy resilience, ensuring continuous operation even during grid downtime.

12.3 Investment Risk–Return Matrix

To help investors visualize the relationship between risk, return, and stability, the following matrix illustrates relative positioning for each investment scenario.

[Chart 3: Investment Risk–Return Matrix]

| Investment Type | Return Level | Risk Level | Long-Term Sustainability | Recommendation |

|---|---|---|---|---|

| Urban Grid-Fed Charger | Medium | Low | High | Stable, suitable for conservative investors |

| Rural Weak-Grid Hub | High | High | Medium | Best for strategic investors with tech support |

| Solar + Battery Hybrid | High | Medium | Very High | Balanced — ideal for long-term ROI |

| Fleet/Commercial Charging | Very High | Medium | High | Quick payback and stable cash flow |

| Public-Private Partnership (PPP) | Medium | Low | Very High | Ideal for government or ESG-aligned firms |

Conclusion:

Projects combining Anengjienergy’s hybrid systems + fleet partnerships yield the best balance between risk and long-term sustainability.

12.4 Weak-Grid Infrastructure Blueprint

[Chart 4: Modular Infrastructure Concept]

| Component | Function | Anengjienergy Solution Example |

|---|---|---|

| Power Input | Grid + Solar + Battery | Hybrid Controller 300kW with load balancing |

| EV Charger | DC 20–1440kW / AC 7–44kW | Smart DC/AC Charger Series |

| Energy Storage | 100–500kWh lithium pack | Containerized ESS Modules |

| Management System | Cloud + IoT platform | Anengjienergy Smart Cloud |

| Revenue System | Payment + API + Dashboard | Fleet, retail, advertising integration |

Design Principle: Modularization enables gradual capacity expansion with minimum disruption and lower upfront cost.

12.5 Regional Profitability Case Studies (Summary)

| Region | Example Country | Energy Source Mix | Avg. Utilization | ROI (Years) | Remark |

|---|---|---|---|---|---|

| Europe | Poland | Grid + Solar | 42% | 3.9 | Supported by EU renewable fund |

| Russia | Russia | Grid + Diesel Backup | 28% | 5.5 | Grid instability challenges |

| Southeast Asia | Vietnam | Solar + Grid | 46% | 3.8 | Fast urbanization, high EV policy support |

| Middle East | Saudi Arabia | Solar + Storage | 50% | 3.5 | Strong solar resource, large land area |

| South America | Brazil | Grid + Solar | 40% | 4.2 | Government incentive for clean mobility |

12.6 Strategic Recommendations for Investors

1. Start Modular, Grow Scalable

Begin with low-power AC units (7–44kW) and scale to high-power DC chargers (20–1440kW) as EV adoption grows.

2. Integrate Hybrid Energy

Combine solar and battery systems to achieve independence from unstable grids and reduce operational costs.

3. Diversify Revenue Streams

Beyond charging — add advertising displays, fleet partnerships, carbon credit sales, and energy reselling.

4. Collaborate Locally

Partner with governments, property developers, and logistics operators for shared infrastructure models.

5. Focus on Long-Term ROI

Adopt a 5–10 year investment horizon, where cumulative energy cost savings and ESG incentives deliver compounding returns.

12.7 Investment Blueprint Summary

12.8 Final Conclusion — Powering Sustainable Growth Where the Grid Is Weak

Even in markets where electrical grids are unstable, Anengjienergy empowers investors to build resilient, profitable, and future-ready EV charging ecosystems.

By integrating 20–1440kW DC fast chargers, 7–44kW AC smart systems, and hybrid solar-storage solutions, the company bridges the gap between energy limitation and sustainable opportunity.

From Europe to Southeast Asia, from the Middle East to South America —

Anengjienergy transforms weak grids into strong business foundations for the next generation of electric mobility.

13. Anengjienergy’s Product Solutions

Anengjienergy provides DC fast chargers (20kW–1440kW) and AC chargers (3.5kW–44kW) designed for adaptability, durability, and high efficiency.

DC chargers: Ideal for highways, industrial parks, and fleets.

AC chargers: Perfect for commercial parking lots, hotels, and retail areas.

Hybrid containers: Integrated solar-storage solutions for off-grid or semi-grid operation.

All systems are equipped with smart monitoring, load balancing, and remote control, ensuring stable operations even in weak-grid environments.

14. Future Outlook & Sustainability Trends

The future of EV charging in weak-grid regions lies in distributed energy, hybridization, and digital management.

Governments are introducing incentives for solar-based charging stations — particularly in Central Asia, Southeast Asia, and Africa — to encourage private-sector investment.

Anengjienergy continues to expand its global partnerships, offering turnkey EPC services, energy audits, and financial modeling support to help investors navigate complex markets.

15. Conclusion: Turning Challenges into Profit

While weak-grid conditions pose real challenges, they also present high-entry-barrier opportunities with long-term rewards.

By adopting hybrid PV-storage-charging systems, investors can minimize risk, maximize ROI, and accelerate regional electrification.

16. Call to Action

Build the Future of EV Charging with Anengjienergy

Whether in Africa, Central Asia, or South America, Anengjienergy helps investors overcome infrastructure limits with flexible, modular, and profitable EV charging systems.

💬 Contact us today for a customized ROI analysis and project proposal tailored to your local grid conditions.