As electric vehicles (EVs) accelerate toward mass adoption, the hospitality industry in 2025 is undergoing one of its biggest infrastructure transitions in decades. Guests increasingly expect convenient, reliable EV charging as a standard hotel amenity—similar to Wi-Fi or parking availability. For hotels, choosing the right EV charging technology is no longer optional; it directly affects bookings, guest satisfaction, revenue potential, and brand competitiveness.

However, the decision between Level 2 charging (AC) и DC fast charging (DCFC) is complex. Each option carries different costs, infrastructure requirements, installation challenges, and ROI implications. Furthermore, the ideal solution varies significantly depending on the hotel’s profile—luxury hotels, chain hotels, and resort hotels all have different operational realities and guest expectations.

This expanded guide provides an in-depth comparison of Level 2 and DCFC solutions, tailored to the needs of three major hotel categories, supported by real data, industry trends, and hotel-specific operational insights.

Why EV Charging Matters for Hotels in 2025

The Rapid Rise of EV Travelers

The number of EV-driving hotel guests is surging, and the trend will continue accelerating throughout 2025 and beyond.

Key data points:

Global EV ownership exceeded 50 million in 2025 (IEA)

78% of EV drivers “prefer or strongly prefer” accommodations with on-site charging (Booking.com)

Hotels with the “EV Charging” tag on Google Maps see 19–28% more search impressions

EV drivers spend 14–27% more time on hotel grounds while charging, boosting on-site consumption

Европа

United Kingdom

Best public facts: Only ~1 in 5 hotels currently offer on-site EV charging (industry commentary); UK EV-driver surveys show many EV drivers factor charging into hotel choice. UKHospitality+1

Proxy (implication): UK BEV/new-car share is rising but not as high as Nordic countries.

Estimated hotel-guest EV share: Medium (≈8–15%) — Medium confidence.

Rationale: rising EV ownership plus strong stated preference among EV drivers to choose hotels with chargers, but hotel charging rollout is still limited. UKHospitality+1

Франция

Proxy: 2024 BEV registrations ~16–17% of new cars (EAFO / national stats). alternative-fuels-observatory.ec.europa.eu

Estimated hotel-guest EV share: Medium (≈8–18%) — Medium confidence.

Rationale: meaningful BEV market share suggests a non-trivial share of guests will be EV drivers, but direct hotel surveys are scarce. alternative-fuels-observatory.ec.europa.eu

Германия

Proxy: BEV share of new registrations in 2024–25 around high-teens (varies month to month; market trending upward). Autovista24+1

Estimated hotel-guest EV share: Medium (≈8–20%) — Medium confidence.

Rationale: rising EV registration share and strong urban EV adoption, but hotel-guest specific data not published publicly. Autovista24+1

Италия

Proxy: BEV share lower than core EU markets in 2024 (growth but from a smaller base; many reports show double-digit growth but lower market share than France/Germany). Autovista24+1

Estimated hotel-guest EV share: Low–Medium (≈3–10%) — Low/Medium confidence.

Rationale: EV registrations growing rapidly but overall penetration still behind core EU markets. Autovista24

Sweden

Proxy: Very strong plug-in/new registration share (Nordic markets show >50% plug-in/new in some months). alternative-fuels-observatory.ec.europa.eu+1

Estimated hotel-guest EV share: High (≈20–40%) — Medium confidence.

Rationale: high national EV penetration implies a substantial share of hotel guests are EV drivers. alternative-fuels-observatory.ec.europa.eu+1

Норвегия

Proxy / fact: ~89% of new cars sold in 2024 were fully electric — world-leading adoption. 路透社

Estimated hotel-guest EV share: Very high (>40%) — High confidence.

Rationale: near-complete electrification of new sales means many visitors (domestic drivers and many rental fleets) are EVs; hotels should assume very high EV guest prevalence. 路透社

Россия

Proxy: EV sales are growing from a small base; 2024 EV unit counts are still low relative to total passenger car sales. MarkLines+1

Estimated hotel-guest EV share: Low (<5%) — Low confidence.

Rationale: EV market is nascent; hotel-guest EV share likely small but could vary significantly by city/region. MarkLines+1

Central Asia & Middle East

Казахстан

Proxy: Very small EV fleet share in 2024–2025 (only low-thousands registered); adoption nascent. energyprom.kz+1

Estimated hotel-guest EV share: Low (<2–3%) — Low confidence.

Узбекистан

Proxy: Rapidly rising EV imports and early adoption in 2024–2025, but overall market still emerging. daryo.uz+1

Estimated hotel-guest EV share: Low–Medium (≈2–8%) — Low confidence.

Jordan

Proxy / notable stat: A very high proportion of new car sales reported electric in 2024 (journalistic reporting cites ~65% new EV sales in 2024). This is an exceptional outlier globally. 福布斯

Estimated hotel-guest EV share: Potentially High (15–40%) — Low/Medium confidence.

Rationale: if new car sales are truly dominated by EVs, the guest mix may rapidly reflect this — but verify with local hospitality surveys. 福布斯

United Arab Emirates (UAE) & Saudi Arabia

Proxy: GCC markets (UAE, Saudi) are rapidly expanding EV infrastructure and consumer interest; Roland Berger’s EV Charging Index shows strong roll-out and satisfaction metrics in the GCC. Роланд Бергер+1

Estimated hotel-guest EV share: Medium (5–20%) — Low/Medium confidence (varies by city & tourist segment).

Rationale: urban and high-income segments will have higher EV rates (Dubai, Abu Dhabi, Riyadh), but the overall market mix depends on tourist origin and rental fleets. Роланд Бергер

Asia (East & Southeast)

Южная Корея

Proxy: EV market accelerating; BEV share of overall auto market has been climbing but figures vary by source (reports show single-digit to low-teens share in 2024). Focus2Move+1

Estimated hotel-guest EV share: Medium (5–15%) — Medium confidence.

Япония

Proxy: Mixed trends — electrified vehicles (hybrids + BEVs) significant, pure BEV sales have been volatile in 2024. jato.com+1

Estimated hotel-guest EV share: Low–Medium (≈3–12%) — Low/Medium confidence.

Таиланд

Proxy: Rapid growth; by 2025 monthly/annual BEV registrations rising toward ~15–20% in some months/segments (market is expanding). nationthailand

Estimated hotel-guest EV share: Low–Medium (≈5–12%) — Low confidence.

Philippines & Indonesia

Proxy: Fast growth from a low base. Indonesia sold tens of thousands of BEVs in 2023–2024 but overall penetration still low (~5% or less of total fleet). Philippines still small but growing. ibc-bulletin-vol4.vercel.app+1

Estimated hotel-guest EV share: Low (<5%) — Low confidence.

Oceania

Australia

Proxy: BEV/new-car share roughly ~9–10% in 2024 (EV market accelerating). electricvehiclecouncil.com.au+1

Estimated hotel-guest EV share: Medium (5–15%) — Medium confidence.

New Zealand

Proxy: Electrified vehicles have had high market share of new registrations recently (data sources show a high plug-in proportion in 2024–2025 months). EVDB NZ+1

Estimated hotel-guest EV share: Medium (8–20%) — Medium confidence.

The data highlights one clear reality:

EV charging is no longer a niche perk—it’s a mainstream expectation.

How Charging Amenities Influence Guest Booking Behavior

EV drivers demonstrate strong preference behaviors, which significantly influence hotel bookings:

42% of EV guests filter hotels by “EV Charging”

31% are willing to switch hotels—even if the alternative is more expensive

56% of EV travelers check charger availability before arrival

34% specifically avoid hotels that offer only Level 1 charging or slow charging solutions

This behavior is particularly strong among higher-income EV owners—Tesla, BMW, Mercedes EQ, and Lucid drivers—making the availability and type of charging especially important for the luxury hotel segment.

Competitive Advantage for Hotels Offering EV Charging

Hotels equipped with proper EV charging infrastructure enjoy measurable business advantages:

3–7% higher occupancy

Longer average dwell times

Increased F&B revenue (6–23% higher depending on hotel type)

Higher guest loyalty and better review scores

Increased revenue from non-guest charging in high-traffic areas

Hotels that implement a well-designed EV charging strategy—especially those aligned with their guest demographics—see the fastest ROI and strongest competitive differentiation.

Understanding Hotel EV Charging Options

What Is Level 2 Charging? (AC Charging)

Level 2 charging is the most common EV charging option for hotels due to its cost-effectiveness, easy installation, and suitability for overnight stays.

Technical Characteristics

Power levels: 7 kW, 11 kW, 22 kW

Charging time: 4–10 hours for a full charge depending on vehicle and power level

Electrical requirement: 208–240V AC

Charging connectors: Type 2, J1772, GB/T (market dependent)

Расходы на установку

Hardware: $700–$1,600

Installation: $2,000–$6,000

Network setup: $200–$600

Advantages for Hotels

Ideal for overnight guests

Minimal electrical upgrades

Low ongoing costs

Easy to scale horizontally (multiple ports)

Enhances guest satisfaction without disrupting operations

Ideal For

Luxury hotels

Resort hotels

Chain hotels with typical overnight customers

What Is DC Fast Charging (DCFC)?

DC fast charging delivers high-power charging directly to the battery, dramatically reducing charging time.

Technical Characteristics

Power levels: 60 kW, 120 kW, 180 kW, 240 kW, 360 kW

Charging time: 15-45 минут

Electrical requirement: 480V three-phase

Requires high-capacity transformers and utility approvals

Расходы на установку

Hardware: $18,000–$90,000+

Installation: $40,000–$200,000+

Transformer upgrades may add $15,000–$300,000

Advantages

Attracts non-guest EV drivers

Generates significantly higher revenue than Level 2

Ideal for properties near highways or travel corridors

Ideal For

Highway chain hotels

Business hotels in high-traffic areas

Hotels aiming to become public charging hubs

Challenges Hotels Face When Installing EV Chargers

1. Electrical Capacity Limitations

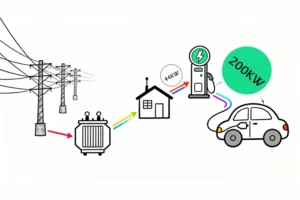

Many hotels lack the spare electrical capacity required for DCFC.

However, a single 120–180 kW DC fast charger may require:

300–500 kW total load support

Major transformer upgrades

This makes Level 2 the more practical solution for most hotels—especially luxury and resort properties located in older buildings or remote areas.

2. Parking Layout & Guest Flow Challenges

Hotels encounter multiple parking management constraints:

87% lack dedicated EV parking capacity

64% struggle with traffic flow congestion

Many guests park for long durations, blocking DCFC turnover

EV charging spaces cannot obstruct valet operations or entrances

Resorts often have large parking lots but long cable runs

These differences affect the optimal charger type depending on the hotel category.

3. High Upfront Costs for DCFC

While Level 2 chargers are typically easy to justify financially, DCFC can strain hospitality budgets:

Level 2 system per port: $3,000–$7,000

DCFC system per station: $65,000–$250,000+

Additional costs:

Trenching & conduit: $20–$80 per foot

Long-distance cable installs (common in resorts)

Annual network & insurance fees

Given these cost layers, DCFC investment must be strategically aligned with hotel type and business model.

4. Regulatory Barriers

Hotels often face:

2–4 weeks for local permitting

1–4 months for utility approvals

Specialized fire codes for electrical rooms

Restrictions in historic or protected buildings (common for luxury hotels)

5. Uncertain ROI

Average monthly revenue (2025):

Level 2: $40–$120 per port

DCFC: $400–$2,400 per station

Payback periods:

Level 2: 18–36 months

DCFC: 4–7 years

But ROI varies dramatically between hotel types—which we will analyze in detail next.

Which Charging Option Fits Your Hotel Type?

A Deep Comparison Across Luxury, Chain, and Resort Hotels**

This is the core of your requested expansion.

Below is a highly detailed, hotel-type–specific analysis with extensive comparison data.

1. Luxury Hotels

(5-star, high-end boutique, premium urban locations)**

Luxury hotels serve a premium clientele that drives higher-end EVs and expects impeccable service quality. Charging solutions must match the brand’s positioning and guest expectations.

Guest Profile

High-income EV owners (Tesla Model S/X, EQS, Mercedes EQ series, BMW i7, Porsche Taycan)

High expectations for convenience & experience

Typically stay 1–3 nights

Expect professionally managed charging, not self-service chaos

More likely to request valet charging or concierge assistance

Charging Needs Analysis

Overnight charging is the primary need

Charging must be quiet, elegant, and integrated into premium parking areas

Must avoid large, visible DCFC equipment disrupting hotel aesthetics

Charging should be part of loyalty or VIP benefits

Guests value reliability more than speed

Best Solution for Luxury Hotels

Primary: Level 2 Charging (11–22 kW)

Matches overnight stay patterns

Lower noise & heat output

Minimal infrastructure and aesthetic impact

Allows hotels to install multiple chargers in VIP parking zones

Great for valet-managed charging

Secondary: 1–2 DC Fast Chargers (120–180 kW)

For VIP guests, business travelers, or concierge-assisted “express charging.”

Recommended Deployment Volume

Ideal deployment model for luxury hotels (make into table)

200+ rooms

8–15 Level 2 chargers

1–2 DCFC for VIP fast charging

Revenue & ROI Considerations

Luxury hotels should prioritize guest satisfaction over raw revenue

Level 2 provides strong ROI with minimal disruption

DCFC ROI depends on whether hotel wants to attract non-guests

Summary for Luxury Hotels

Level 2 is the backbone; DCFC is optional for VIP differentiation.

2. Chain Hotels

(Holiday Inn, Hampton, Marriott Courtyard, Ibis, etc.)**

Chain hotels prioritize efficiency, standardized operations, and cost-effective investments. They serve a wide mix of travelers, including business, highway travelers, families, and overnight guests.

Guest Profile

Mid-income EV drivers

Higher percentages of one-night stays

Mix of highway and urban travelers

Expect dependable charging for practical needs

More price-sensitive than luxury hotel guests

Charging Needs Analysis

Must balance cost and coverage

Need predictable ROI

High turnover means some guests want fast charging

Hotels near highways benefit substantially from DCFC traffic

Best Solution for Chain Hotels

Primary: Level 2 (7–11 kW)

Affordable

Sufficient for overnight guests

Works well with chain hotel operational models

Secondary: 1 DC Fast Charger for Highways or Business Districts

Attracts public charging users

Generates significantly higher revenue

Improves hotel visibility on charging apps (PlugShare, Google Maps, ChargePoint)

Recommended Deployment Volume

Suggested deployment for medium chain hotels (100–200 rooms)

4–8 Level 2 chargers

0–1 DC fast charger depending on traffic volume

Revenue & ROI Considerations

Chain hotels are the most likely to profit from hybrid L2 + DCFC systems

DCFC can turn hotels into local charging hubs

Hotels near highways can achieve ROI of 14–24 months for DCFC

Summary for Chain Hotels

Hybrid systems deliver the best balance of guest satisfaction and revenue generation.

3. Resort Hotels

(Beach resorts, mountain lodges, remote vacation destinations)**

Resort hotels provide extended stays, scenic locations, and a relaxing environment. Guests expect seamless amenities that enhance long-term comfort.

Guest Profile

Longer overall stay duration (2–4 nights)

Families traveling long distances

High likelihood of driving EV to destination

Expect convenience over speed

Less likely to need fast charging

Strategic location usually far from high-power utility lines

Charging Needs Analysis

Overnight and multi-night charging ideal

Level 2 fits long-stay patterns perfectly

DCFC adds little extra value

Resorts often have large parking areas, making L2 scalable

DCFC electrical upgrades are expensive due to remote locations

Best Solution for Resort Hotels

Primary: Level 2 Charging (11–22 kW)

Perfect for multi-day stays

Lower cost makes it easy to install 10–20 ports

Supports all EVs, including rental and guest-owned

Enhances guest satisfaction with minimum investment

Optional: DCFC

Only useful if the resort is on a major travel corridor.

Recommended Deployment Volume

Suggested deployment for resorts with 150–300 rooms

10–20 Level 2 chargers

0–1 DCFC (optional)

Revenue & ROI Considerations

Level 2 ROI is extremely strong due to high utilization

DCFC rarely recovers its cost in resort environments

Guests prefer slow charging because they remain on property for long durations

Summary for Resort Hotels

Level 2 solves 90–95% of charging needs—DCFC usually unnecessary.

EV Charger Deployment Recommendations for Three Hotel Types (Luxury, Chain, Resort)

| Hotel Type | Recommended Number of Level 2 Chargers | Recommended Number of DC Fast Chargers | Primary Use Cases | Target Guest Segments | Power Infrastructure Considerations |

|---|---|---|---|---|---|

| Luxury Hotels | 8–15 units | 4-8 units (120–180 kW) | VIP fast charging + overnight slow charging | High-end EV drivers, premium guests, business travelers | Must avoid negatively impacting hotel aesthetics; prioritize valet areas or designated premium parking zones |

| Chain Hotels | 4–8 units | 3-6 unit (optional) | Mixed use: public charging + overnight guest charging | Business travelers, families, highway transient guests | If located near highways, DC fast chargers are beneficial; typical buildings have moderate electrical capacity |

| Resort Hotels | 10–20 units | 2-4 unit (depending on location) | Primarily overnight/long-stay charging | Family vacationers, long-stay leisure guests | Large parking areas but long cable distances increase installation cost; electrical upgrades often req |

Direct Comparison: Luxury vs. Chain vs. Resort Hotels

Charging Demand Characteristics

| Hotel Type | Stay Duration | EV Guest Behavior | Charger Needs |

|---|---|---|---|

| Luxury | 1–3 nights | Expect premium service, valet charging | Level 2 + VIP DCFC |

| Chain | 1 night | Mix of overnight + highway travelers | Level 2 + optional DCFC |

| Resort | 2–4 nights | Long-stay, relaxed schedule | Level 2 only |

Electrical Infrastructure Feasibility

| Hotel Type | Electrical Upgrade Need | DCFC Feasibility | Notes |

|---|---|---|---|

| Luxury | Medium | Possible but aesthetic concerns | Prefer L2 in valet zones |

| Chain | Средний и высокий | High ROI for highway locations | DCFC works best here |

| Resort | Высокий | Often impractical | Remote areas → costly upgrades |

Recommended Charger Mix

| Hotel Type | L2 Quantity | DCFC Quantity | Rationale |

|---|---|---|---|

| Luxury | 8–15 | 4-8 | VIP experience + overnight charging |

| Chain | 4–8 | 3-6 | Balanced demand + public revenue |

| Resort | 10–20 | 2-4 | Long stays → L2 dominant |

Cost Breakdown for Hotels in 2025

You can use these figures for charts.

Level 2 (per port)

Hardware: $700–$1,600

Construction: $1,200–$3,000

Electrical: $800–$2,500

Network: $200–$600

DCFC (per station)

Hardware: $18,000–$90,000

Construction: $10,000–$40,000

Electrical: $10,000–$80,000

Transformer upgrades: $15,000–$300,000

Installation Roadmap for Hotels

Conduct electrical load study

Identify guest use cases

Select charger mix

Plan parking layout

Submit permitting

Coordinate with utility company

Install & commission

List charging stations on OTA platforms

Promote charging on Google Maps, PlugShare, etc.

Why Hotels Choose Anengjienergy

(Anchor ID: why-choose-anengjienergy)

Anengjienergy provides end-to-end EV charging solutions specifically optimized for the hospitality sector.

Comprehensive Hardware Offering

Level 2 and DC fast chargers

60 kW – 480 kW DCFC options

Built for hotel-grade reliability and outdoor durability

Global Certifications

CE / TUV / CB / CQC / Russian

Compliant with regulations in Europe, South America, Central Asia, Middle East, Russia, Southeast Asia, Asia, Oceania

Advanced Software Platform

Remote monitoring

Smart billing & payment integration

Load balancing

Energy optimization

24/7 uptime management

Multi-Protocol Support

CCS

CHAdeMO

GB/T

Ensures compatibility with all EVs across global regions.

Hotel Case Studies Using Anengjienergy Chargers

Russia – Apartment Hotel (180 kW DCFC)

Achieved full charger utilization due to high public traffic

Added a competitive differentiator within the region

High ROI due to strong commuter demand

Thailand – Beach Resort (120 kW DCFC + Level 2)

Guests stayed longer in F&B areas

Restaurant revenue increased 22%

Improved guest satisfaction ratings

Germany – Business Hotel (180 kW DCFC)

ROI achieved in 11 months

Became a local charging hub for business commuters

Increased Google visibility and booking selection rate

Conclusion: Which EV Charger Is Best for Your Hotel?

Level 2 Is Best When:

Your guests stay overnight

You’re a luxury or resort hotel

You want fast ROI

You need a low-maintenance system

DC Fast Charging Is Best When:

You are near a major highway

You want to attract non-guest revenue

You have strong electrical infrastructure

Final Recommendation

For 80–90% of hotels,

Level 2 provides the best balance of cost, convenience, and ROI.

DCFC is beneficial primarily for highway chain hotels, business districts, or hotels aiming to become public charging hubs.