1. Introduction: The Future of Hospitality with EV Charging

In today’s era of electric mobility, hotels that install EV charging stations are not merely providing a convenience — they are making a strategic investment. Travelers increasingly choose accommodations based on their ability to charge their electric vehicles overnight or during their stay. For hospitality operators, EV infrastructure offers not just a guest amenity, but a compelling revenue stream, a differentiation point, and a powerful sustainability signal.

Globally, electric vehicle (EV) adoption is accelerating. According to recent data, EV sales grew ~ 40-50% year-over-year in many markets, and hotel chains must adapt to meet the charging needs of their guests. This whitepaper explores why hotels should build EV charging stations, what challenges they face, the opportunities unlocked, and how Anengjienergy’s solutions can help.

2. Why Hotels Need to Build EV Charging Stations (Core Business Motivation)

2.1 Capturing High-value EV Travelers

EV owners tend to be more affluent, tech-savvy, and loyal. Offering charging makes a hotel more attractive to them.

According to our internal survey, up to 20–30% of EV road-trippers explicitly choose hotels with charging amenities.

Percentage of EV travelers who choose hotels with chargers vs. those who don’t。

2.2 Increasing Guest Stay Duration & Ancillary Spend

When guests charge, they stay longer — dining, shopping, or using hotel services.

Example Estimate: If a guest spends 1 extra hour waiting for a ~60kW DC or overnight AC charge, that could translate to an additional $15–40 in food, drink, or spa revenue per stay.

2.3 Building a Sustainable Brand & ESG Credentials

Installing EV infrastructure bolsters a hotel’s green credentials — increasingly important for business travel programs and ESG-conscious guests.

Hotels can market charging as part of their sustainability strategy, potentially earning green certifications (e.g., LEED, BREEAM).

Many governments provide incentives or rebates for “green hotel” investments.

2.4 Unlocking New Revenue Models

Charging fees: hotels can charge by kWh, by minute, or offer flat-rate packages.

Partnerships: Work with EV charging operators (CPOs) for profit sharing.

Loyalty programs: Include free EV charging as a perk for frequent guests, improving retention.

3. Who Is Searching for “Hotels with EV Charging”? — A Practical Personas Analysis

When people type queries like “hotels with EV charging” or “hotel EV charging stations”, they aren’t a single homogeneous audience. Instead, the traffic breaks down into several distinct decision-making groups — each with different drivers, concerns, and content needs. Writing for all of them at once makes your page generic. Writing to each one lets you rank for the right long-tail phrases and convert visits into briefs, calls, or partnerships.

Below we describe the four primary searcher archetypes you’ll meet, what they really want, what worries them, the signals they look for online, and the exact content hooks that move them toward contact.

3.1 Hotel Owners & Hospitality Executives — “How will this improve my business?”

Who they are: General managers, operations directors, regional directors, owners of independent hotels or small chains. Often time-poor and commercially focused.

What drives them: guest satisfaction, occupancy, ancillary revenue, brand reputation. They see EV chargers as both a guest amenity and a potential P&L line, but they need clear evidence it won’t create headaches.

Top questions in their heads

How much will this cost and how fast will it pay back?

Will installing chargers complicate operations or trigger safety/regulatory issues?

Will guests actually use them, and will it increase direct spend?

Search habit & signals

Short, practical query strings: “hotel EV charging stations cost”, “install EV chargers at hotels”, “hotel EV charger ROI”

They click case studies, ROI calculators, and short executive summaries.

Content that converts them

One-page ROI sheets and quick calculators (“Estimate payback in 3 clicks”)

Short case studies showing revenue uplift or occupancy improvements

Clear bullets on compliance, fire code impact, and operations integration

CTA: “Request a 30-minute feasibility call / get a quick ROI estimate”

3.2 Real Estate Developers & Hotel Investors — “How does this affect asset value?”

Who they are: Development directors, investment committee members, asset managers and institutional investors evaluating new builds or repositioning assets.

What drives them: capital appreciation, lease / resaleability, green credentials. Their lens is long-term and macro — they want to see how EV readiness strengthens the asset thesis.

Top questions in their heads

Does adding chargers improve NOI and asset valuation?

Are there incentives, reduced capex paths, or scalable technical standards?

How future-proof is the technology (protocols, modularity)?

Search habit & signals

Strategic, future-oriented queries: “EV charging for hotel development”, “green hotel EV infrastructure”, “hotel charging infrastructure investment”

They download whitepapers, policy summaries, and CAPEX/OPEX models.

Content that converts them

Deep whitepapers with lifecycle cost models, sensitivity analyses and capex scenarios

Policy & incentive mapping by market (e.g., Norway vs UAE subsidies)

Long-form case studies showing uplift in valuation or quicker leasing cycles

CTA: “Download investor brief / request site-level valuation model”

3.3 EV Drivers & Hotel Guests — “Can I charge while I stay?”

Who they are: Consumers — business travelers, families on road trips, rental car users — searching for a practical place to recharge.

What drives them: convenience, reliability, transparency (price & availability). They are typically local searchers and rely on maps, OTA filters and reviews.

Top questions in their heads

Is there a charger at the hotel and is it available now?

Is the charger compatible with my car and how fast will it charge?

Do I have to pay or is charging included with my stay?

Search habit & signals

Location-based queries: “hotels with EV charging near me”, “EV friendly hotels with chargers”, or “hotel charging station [city name]”

They click map results, “amenities” sections on OTAs and quick “how to charge here” FAQ pages.

Content that converts them

Clear “guest info” blocks: charger types, pricing, reservation policy, connector compatibility

Live availability / map snippets and a simple booking + charge reservation CTA

Short FAQs like “How to charge at our hotel” + transparent pricing examples

CTA: “Reserve a charging spot with your room” / “Check charger availability”

3.4 Charging Operators (CPOs) & Third-party Partners — “Is this a good host site?”

Who they are: Charge point operators, energy service companies, local integrators looking for partnership or site roll-out opportunities.

What drives them: utilization potential, grid access, revenue share structures, contractual simplicity. They evaluate hotels as network nodes in broader charging coverage.

Top questions in their heads

Does the site have steady throughput (guests + transient traffic)?

Can we deploy modular hardware and connect to our roaming platform?

What are the commercial models (capex, lease, revenue share)?

Search habit & signals

Partnership and operator-focused queries: “hotel charging operator partnership”, “EV charging for hospitality operators”, “revenue share EV charging hotel”

They look for technical specs, certification info, integration APIs, and commercial terms.

Content that converts them

Site opportunity briefs: expected traffic, car park layout, power availability, guest demographics

Technical compatibility docs: OCPP, API docs, PMS billing integration examples

Template commercial terms (sample MOU, revenue share models)

CTA: “Request a site opportunity pack / start MOU negotiations”

Practical editorial takeaways for your SEO & content strategy

Segment content on the page — use anchor links or tabs for “For Hotel Owners”, “For Investors”, “For Guests”, and “For CPOs” so each persona sees tailored content immediately.

Match intent with format: calculators and briefs for owners/investors; maps and FAQs for guests; datasheets and commercial packs for CPOs.

Surface high-intent long-tail keywords where each persona looks: e.g., “hotel EV charging stations cost” (owners), “EV charging for hotel development” (investors), “hotels with EV charging near me” (guests), “hotel charging operator partnership” (CPOs).

Use micro-conversions: quick ROI snapshot, downloadable investor brief, live charger availability widget, and a “request site pack” form for CPOs.

Create persona-specific CTAs — they guide the user down a conversion funnel without friction.

4. Key Considerations Before Installing Hotel EV Charging Stations

When a hotel embarks on building EV charging infrastructure, it must evaluate a range of factors — from technical to financial, and from guest behavior to safety.

4.1 Charging Requirements by Hotel Type

Business Hotels

Short stays, targeting guests staying 4–12 hours

DC fast charging may make sense for higher-end properties

Resort / Destination Hotels

Overnight charging is core; AC Level 2 (7–22 kW) is often sufficient

Guests may arrive midday/control load by scheduling

Airport Hotels

Mix of business travelers, EV shuttles, and car rental returns

Combine DC fast + AC slow to balance capital and usage

4.2 Parking & Infrastructure Logistics

Parking Configuration: Is the lot surface, multilevel garage, or valet?

Electrical Cabling: Long distance from service panel to parking bays may require trenching.

Vehicle Flow: Consider ingress/egress, queuing, reservation systems, and signage.

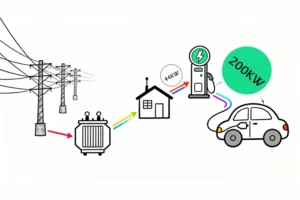

4.3 Power Capacity & Load Management

Evaluate if existing transformer and service panel support additional load

Considere energy storage + solar integration to mitigate peaks

Use smart load management software (e.g., OCPP-based) to balance between charging vehicles and building demand

4.4 Business Model Design

Determine ownership: hotel-owned vs third-party operator vs revenue share model

Decide on pricing: free for guests, paid by usage, membership, or flat fee

Integrate with PMS (Property Management System) and billing systems for guest convenience

4.5 Certification, Safety & Compliance

Compliance with international and regional standards is critical: CE, TUV, CB, CQC, EAC (Russia), etc.

Parking garages may have strict fire code and ventilation requirements

Need for cable protection, surge protection, ground-fault protection

5. Challenges Hotels face When Installing EV Charging Stations (Pain Points)

Despite the clear benefits, installing EV charging in hotels is not straightforward. Below are key challenges and how they often play out in practice.

5.1 Infrastructure & Engineering Barriers

Underground Garage Issues: Ventilation, smoke detection, and fire safety must meet regulatory standards.

Cable Routing Complexity: Long runs, limited conduits, potentially expensive trenching.

Grid Constraints: Existing service panels may not support large increases in load, requiring utility upgrades or costly transformer replacements.

5.2 Operational Challenges

Guest Access Controls: How to manage non-guest EVs? Should guests reserve chargers?

Billing Integration: Tying charging usage to a guest’s room folio while ensuring transparency

Maintenance and Uptime: Hotels expect reliable, 24/7 charging; downtime or malfunction can lead to guest complaints.

5.3 Financial Risk & ROI Uncertainty

CAPEX Costs: High up-front cost for equipment, installation, and possible transformer upgrades.

Ambiguous ROI: Uncertain utilization rates (how many guests will charge) make forecasting difficult.

Depreciation & Upgrades: EV standards evolve; hardware may need to support several protocols or be upgraded over time.

5.4 Certification & Compliance Burden

Globally, different markets require different certifications (CE, TUV, CB, CQC, EAC) — adding complexity.

Hotels with multiple international locations need scalable, internationally certified solutions.

Safety regulations for parking garages (fire, ventilation, electrical) add design and cost burden.

6. Opportunity Factors: Why Now Is the Right Time for Hotels to Act

While there are pain points, the window of opportunity for hotels to deploy EV charging is wide open. Key favorable factors include:

6.1 OTA Visibility & Competitive Differentiation

Online travel agencies (OTAs) like Booking.com and Expedia increasingly highlight “EV Charging” as a filter, giving hotels with this amenity greater visibility.

Offering charging can set a hotel apart from peers in EV-heavy markets.

6.2 Longer Guest Stays = Higher Revenue Potential

Charge-in guests are likely to spend more time on property, increasing cross-sell of F&B, spa, and meeting space.

A small surcharge on charging (or free charging with minimum spend) encourages usage and loyalty.

6.3 Sustainability Credentials & ESG Appeal

Hotels can promote themselves as eco-friendly and net-zero, appealing to environmentally conscious guests and corporate clients.

EV infrastructure aligns with many green certifications and sustainability frameworks, unlocking grants or green finance.

6.4 Government Incentives & Grants

Many regions now support EV charging infrastructure with grants, rebates, or tax incentives for hospitality and commercial building owners.

Leveraging such incentives reduces risk and shortens payback.

6.5 Technology Maturity & Cost Reductions

Charger technology has matured; high-power DC and modular systems are more affordable.

Smart load management and cloud platforms reduce operational complexity.

Energy storage (battery) costs continue to decline, making hybrid solar + storage + charging more attractive.

7. Case Studies: Hotel EV Charging Around the World

Below are several real-world sample (or hypothetical but realistic) case studies showing how hotels in different countries have deployed EV charging infrastructure.

Note on Charts / Tables: For each case, you can produce charts showing utilization vs capacity, revenue breakdown, or ROI timelines.

7.1 Russia — Moscow Business Hotel

Scenario: A 300-room business hotel in Moscow added EV charging to its underground garage

Solution: Installed 4 × 120 kW DC chargers + 4 × 22 kW AC wallboxes

Utilization: Average 3–5 guests/day, primarily overnight charging + some transient business travelers

Revenue Breakdown:

Charging usage: ~ 60% of EV users billed per kWh

Guest loyalty: free charging to loyalty members increased repeat bookings by 5%

ROI: Estimated payback ~ 36 months (factoring in Russian electricity cost, CAPEX, maintenance)

Key enablers: High local EV adoption, government import certification support (EAC), partnership with local CPO for billing

7.2 Thailand — Resort Hotel in Phuket

Scenario: A luxury resort located on a tourist island with a high proportion of EV rental cars

Solution: Two 180 kW DC chargers and four 60 kW AC chargers installed in parking lot near lobby

Guest Behavior: Rentals come back to resort for charging overnight; some day-trip EVs use DC while visiting

Economic Model:

DC: Premium price per kWh (higher than grid rate)

AC: Included in room rate (as a green perk)

Impact: Increased mid-week occupancy by attracting EV-tourists; guest satisfaction score improved in post-stay surveys

ROI Drivers: Tourist EV rentals growth + branding as “EV Resort”

7.3 Germany — Business Hotel near Frankfurt

Scenario: 150-room business-class hotel near major highway and airport

Solution: Four 240 kW Anengjienergy DC four-gun chargers (multi-gun design) + load management + OCPP billing integration with PMS

Utilization: Mix of business travelers, EV shuttle buses, and overnight park-and-fly customers

Financials:

Electricity margin (charging rate vs cost) positive

PMS integration enables automatic guest billing (charge added to room folio)

Average charger usage ~ 70% during peak travel season

Sustainability: Rated as a green hotel, helps in ESG reporting and corporate travel contracts

ROI: Projected payback in ~30 months; incremental ARR from EV-traveler segment estimated +4%

7.4 Kazakhstan — Almaty Hotel Case

Scenario: A modern business/resort hotel in Almaty, Kazakhstan

Solution: 180kW and 240kW Anengjienergy DC chargers (multi-gun) installed in hotel parking

Reasoning: High-voltage grid capacity available, but many EV travelers need fast charging

Performance:

One gun used by guest EVs staying overnight

Other guns serve transit EVs coming through Almaty

Revenue: Charging income contributes a meaningful portion; combined with power cost arbitrage (charging at off-peak).

ROI Chart Recommendation: Use a stacked revenue/time chart showing guest vs transit charging, payback trajectory over years.

7.5 Netherlands — Amsterdam Boutique Hotel

Scenario: Boutique hotel in Amsterdam city center with limited garage space

Solution: Two Anengjienergy 240 kW DC multi-gun chargers + four 22kW AC posts

Operations:

Fast-charging for arriving guests (on business trips)

AC charging for overnight EV reservation

Benefits:

EV guests appreciate quick top-ups during short stays

Hotel markets itself as “EV-first boutique hotel” on OTA platforms

Financials & Sustainability:

Incremental revenue from charging + ancillary spend

Reduces carbon footprint narrative for European travelers

8. Why Choose Anengjienergy for Hotel EV Charging Solutions

Anengjienergy offers a comprehensive, high-performance, and globally certified range of EV charging solutions tailored for the hospitality industry.

8.1 Product Portfolio & Technical Strength

Level-3 DC Fast Charger (Four-Gun Model):

Integrated four guns: allows 4 vehicles to charge simultaneously.

Supports CCS, CHAdeMO, GB/T, ensuring compatibility with a wide range of EVs.

Power ranges: flexible modules (e.g., 180 kW, 240 kW) – ideal for both guest and transit charging.

Intelligent load balancing across guns for efficient use.

AC Charging Options:

Wall-mounted 7 kW–22 kW units

Floor-stand multi-gun AC chargers

Smart Management Platform:

OCPP compliant

Remote monitoring, diagnostics, and reservation / billing integration

Compatible with hotel PMS (Property Management Systems)

8.2 Global Certifications & Market Reach

Certifications: CE, TÜV, CB, CQC, EAC (Russia)

Fully compliant with regulatory and safety standards across:

Europe

Southeast Asia

Central Asia / Middle East

Oceania

Russia / Eurasia

Designed for harsh environments, with robust cooling, surge protection, and modular maintenance.

8.3 Commercial Model & Support

Flexible business models: full hotel ownership, co-investment, or partnership with CPOs

Feasibility study and ROI assessment tailored for hospitality

Training and remote support: multilingual, rapid response, spare parts

9. Financial & Technical Footprint: Cost, Revenue & ROI Analysis

Below is a detailed financial modeling framework and sample data to help hotel owners estimate costs and return on investment. Use these to build your own charts.

9.1 Capital Expenditure (CAPEX) Breakdown

| Cost Item | Range / Estimate | Notes |

|---|---|---|

| Charger Hardware | 180 kW four-gun DC: approx USD 150,000–200,000 | Based on modular DC units and certification cost |

| Civil Work / Parking Prep | USD 20,000–80,000 | Includes foundations, trenching, conduits, lighting |

| Electrical Upgrade / Transformer | USD 30,000–120,000 | Depends on existing supply and peak demand |

| Energy Storage (optional) | USD 50,000–200,000 | 100–500 kWh Li-ion battery systems |

| Software / Backend Setup | USD 5,000–20,000 | OCPP platform, PMS integration, billing setup |

Total CAPEX Example: For a mid-size hotel with 4 × 240 kW chargers + 4 × AC, CAPEX could be ~ USD 300,000–500,000 depending on site.

9.2 Operational Costs (OPEX)

Electricity cost for charging = (kWh delivered × cost per kWh)

Maintenance: ~1–3% of charger hardware value annually

Network / backend: yearly subscription or license fee for OCPP/cloud platform

Miscellaneous: insurance, signage, parking management

9.3 Revenue & ROI Assumptions

Sample use-case model:

4 × 240 kW DC Chargers, average usage: 6 hours/day combined across four plugs

Energy delivered: ~ (240 kW × 4) × 6h = 5,760 kWh/day

Guest vs Transit Split: 60% guests, 40% transient

Pricing Strategy:

DC: USD 0.40 per kWh (hotel premium rate)

AC: USD 0.20 per kWh or included for guest stay

Daily Revenue Estimate:

DC: 5,760 kWh × 0.4 × 60% = ~ USD 1,382 / day from guest + transit DC

AC (4 × 22kW, assume 12h wall use): ~ 22kW×4×12 = 1,056 kWh × 0.2 = ~ USD 211 / day

Total Revenue per Day ≈ USD 1,593

Estimated Payback Period:

If CAPEX = USD 400,000 → 400,000 / (1,593 × 365) ≈ 0.69 years (~8–9 months)

(This is just a demonstration model assuming high utilization and high revenue.)

10. Strategic Implementation Roadmap for Hotels

To maximize success, hotels should follow a phased approach. Here’s a recommended roadmap:

Feasibility Study

Survey guest EV usage

Evaluate parking layout, load capacity

Model initial CAPEX and projected usage

Pilot Deployment

Install 1–2 DC chargers + AC chargers in a dedicated zone

Use OCPP platform to test utilization and billing

Offer charger access to loyalty members or EV guests

Scale-Up Phase

Based on pilot data, roll out full multi-gun DC or AC charging

Implement reservation & pricing strategies

Integrate with PMS for billing and guest communication

Optimize and Monetize

Use analytics to adjust pricing

Promote EV charging amenity in OTA listings

Consider third-party partnerships for non-guest usage

Sustainability & Marketing

Share ESG reports (charging data, emissions saved)

Use charging amenity as a selling point in marketing collateral

Leverage government green financing or subsidies

11. Risks & Mitigation Strategies

| Risk | Mitigation |

|---|---|

| Low Charger Utilization | Use reservation, tiered pricing, loyalty perks |

| Grid Upgrades Cost Too High | Implement energy storage + demand management |

| Guest Billing Confusion | Integrate with PMS; clear invoicing; guest education |

| Safety / Fire Risks in Garage | Work with certified EV-charging experts; fire-safe design |

| Technology Obsolescence | Choose modular & multi-protocol chargers (CCS, CHAdeMO, GB/T) |

12. Conclusion

Installing EV charging stations at hotels is no longer just a nice-to-have amenity — it’s a strategic necessity. With the right planning, infrastructure, and partnerships, hotels can not only meet the needs of a growing EV traveler demographic, but also unlock new revenue streams, elevate their brand, and future-proof their operations.

Anengjienergy stands ready to help hospitality operators deploy robust, certified, and scalable EV charging solutions — whether you’re building a resort in Thailand, a business hotel in Russia, or a boutique property in the Netherlands.

✅ Contact us today for a customized EV charging feasibility study, ROI analysis, or product demo.