London, July 2025 — London’s electric vehicle (EV) charging network has experienced major expansion over the past four years, with more than 25,500 public chargepoints now installed across the capital, according to the latest infrastructure update from Transport for London (TfL).

The report highlights the city’s growing deployment of ultra-rapid charging hubs with power capacities reaching up to 400kW, underscoring London’s role as one of Europe’s fastest-developing EV infrastructure markets.

Rapid Growth Since 2021

Since the publication of TfL’s first EV infrastructure strategy in December 2021, London’s charging network has nearly tripled in size — up from around 9,000 chargepoints at that time.

As of mid-2025, the city’s infrastructure includes:

20,629 slow and low-power units (up to 8kW)

3,450 fast chargers (8kW–22kW)

654 rapid chargers (50kW–149kW)

776 ultra-rapid chargers (150kW and above)

Over 80% of all installations are residential-style chargepoints, typically integrated into lamp posts and kerbside infrastructure.

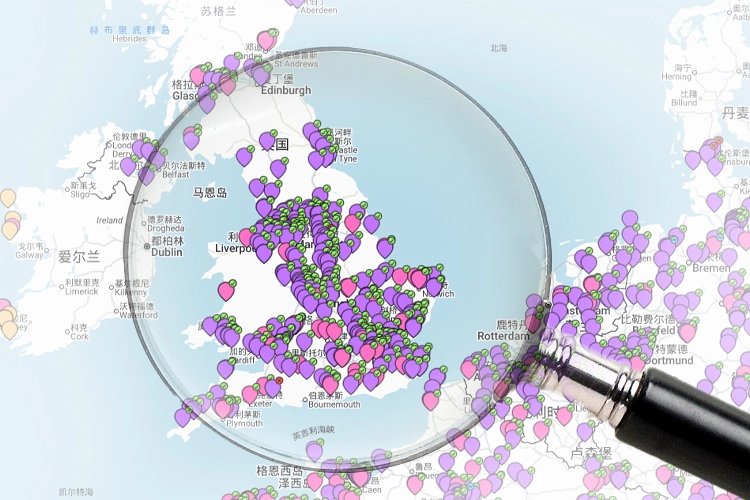

Borough-Level Deployment

Most slow and fast charging installations have been delivered by London borough councils through kerbside and lamp column programs.

The largest increases have been recorded in Hammersmith and Fulham, Westminster, Southwark, Wandsworth, and Hackney in inner London, as well as Waltham Forest, Brent, Richmond, and Merton in outer London.

These deployments primarily serve residents without off-street parking, providing convenient overnight charging options through repurposed street furniture and existing parking bays.

Rise of Ultra-Rapid Charging Hubs

TfL’s latest update confirms that ultra-rapid charging speeds in London have exceeded the standard 50kW systems once common across the network.

Newer installations now include 350kW and 400kW chargepoints capable of servicing modern EVs with higher battery acceptance rates.

The number of hub sites — locations hosting six or more rapid or ultra-rapid chargers — has increased from 14 sites in 2021 to 55 as of July 2025.

An additional 74 cluster sites, each offering three to five rapid chargepoints, are now operational across the city.

Charging Utilisation and Demand

According to data from Zapmap, public chargepoint utilisation remains strong across all categories:

Slow chargers: 46–49% utilisation (approx. 12 hours/day)

Fast chargers: increased from 37% in 2022 to 49% in 2025 (about 11 hours/day)

Rapid chargers: declined from 39% to 27%, as drivers shift toward higher-speed options

Ultra-rapid chargers: steady at around 34% utilisation, or eight hours daily

TfL’s updated modelling now assumes 50% utilisation for slow chargers and 25% for rapid and ultra-rapid units, acknowledging differences in user behavior and parking constraints.

Future Capacity Targets

Based on current adoption trends, London is forecast to require between 43,000 and 51,000 public chargepoints by 2030, including up to 3,500 high-powered units.

By 2035, projections rise to 69,000–79,000 chargepoints, with 4,300 ultra-rapid or rapid chargers needed to support the city’s transition toward full electrification.

These forecasts refine the original 2021 strategy, aligning infrastructure growth with actual EV adoption rates, utilisation patterns, and borough-level deployment capacity.