In today’s rapidly electrifying world, the demand for high-quality EV chargers and full charging infrastructure is no longer just a niche concern — it has become a strategic business imperative. Whether you operate in Europe, South America, Asia (including Southeast Asia), the Middle East, Russia or Central Asia, understanding the evolving landscape of electric vehicle (EV) charging stations is crucial for OEMs, infrastructure providers, utilities, real-estate investors and fleet operators alike. In this blog post we will explore the key market dynamics, real data, regional insights and actionable tips that B2B players can use to assess opportunities in the “EV charger ecosystem”.

1. Market size & growth: the macro picture

Global market

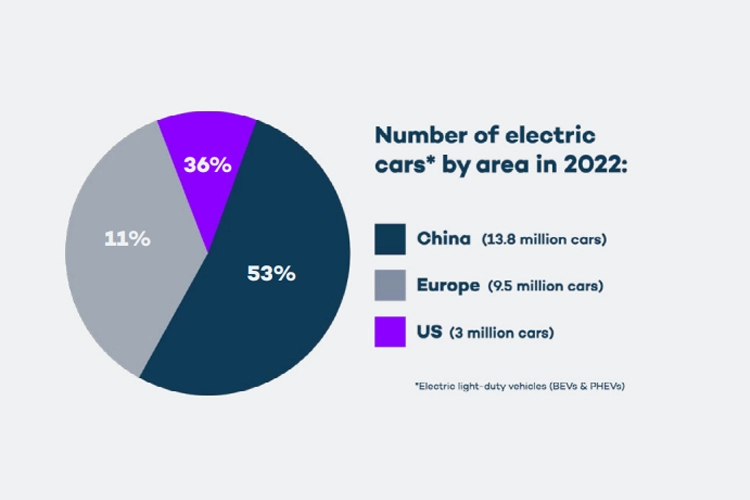

- The global EV charging station market (public + private) is projected to grow from around USD 31.1 billion in 2024 to approximately USD 328.2 billion by 2035, implying a CAGR of ~23.9% from 2025-2035.

- The global market for EV chargers (the equipment side) is also large: for example, a report estimates the global EV chargers market revenue of ~USD 18,496.5 million in 2025, and reaching ~USD 27,473 million by 2033, with a CAGR ~26.2%. (Cognitive Market Research)

Regional breakdown and relevant data

Let’s summarise by key region, all relevant for B2B stakeholders:

| Region | Market size / share & key numbers | Notes for business strategy |

|---|---|---|

| Europe | In 2024 Europe held approximately 38% of the global EV charger market. (marketintelo.com) | With strong regulation (e.g., EU’s emission & infrastructure mandates), Europe remains a mature, competitive but high-opportunity region. |

| Asia-Pacific (incl. SE Asia) | APAC held ~25% of the global EV charging cables market in 2024; CAGR ~17% from 2025-2034. (GlobeNewswire) | Fastest growth region; major potential in China, India, Southeast Asia. |

| Latin America | In 2024 the Latin America electric vehicle charging infrastructure revenue was USD 203.6 million. (Grand View Research) The EV charger market: South America holds ~7.1% of global share in 2025. (Cognitive Market Research) | Emerging market: still early stage — offers greenfield opportunities but also infrastructure / logistics constraints. |

| Middle East & Central Asia / Russia & CIS | Data is less abundant; one report noted Middle East & Africa region saw over 24% of countries launch national EV charging frameworks and ~29% growth in fleet-charging demand. (globalgrowthinsights.com) | Depending on oil/energy policy shifts and urbanization, this region may become an interesting frontier for B2B charging infrastructure. |

Example: Europe & Asia numbers

- In Europe, there were over 450,000 publicly available EV chargers in 2022; by 2025 the estimate is ~1.3 million publicly accessible charging stations; by 2030 approx. 2.9 million. (virta.global)

- In Asia-Pacific: one commentary noted Asia-Pacific contributed over 47% of global growth in charging point installations. (globalgrowthinsights.com)

Takeaway for B2B firms: The market is large and growing fast. For any business involved in manufacture, installation, operations, software or services around EV chargers, there is a multi-region growth story and opportunity to align with the right geographies, product segments and business models.

2. Key product & infrastructure segments in the EV charger ecosystem

When we say “EV charger” or “charging station”, the reality is quite varied. For B2B players, understanding sub-segments is vital.

a) Types of chargers: slow (AC) vs fast (DC)

- Slow / Level 2 (typically AC): suitable for destinations, workplaces, apartment complexes.

- Fast / DC / Ultra-fast chargers: highway rest stops, fleet depots, public rapid charging hubs. A report notes the “Fast Charger” segment contributed over 71.3% of revenue share in 2024 for charging stations.

- Example: In Europe, fast chargers stock surpassed 70,000 by end of 2022 (55% increase from 2021).

b) Application segments

- Residential (home-charging) — though less visible for larger B2B opportunities, unless you are a developer or real-estate investor.

- Commercial / semi-public (office buildings, parking lots, retail)

- Public / highway / fleet charging stations

- Fleet & bus charging (especially interesting in emerging markets)

c) Value-chain and business model implications

From a B2B perspective:

- Hardware manufacture: EV charger units (AC/DC), cables, connectors, mounting systems.

- Installation & civil works: Site preparation, power supply upgrades, grid connection.

- Software & services: Network management, monitoring, payment systems, interoperability. (Key in Europe & Asia).

- Operations & maintenance (O&M): uptime, reliability, service contracts.

- Energy / grid integration: As charging volumes grow, smart grid, storage, renewable integration become relevant. Example: a report noted charging stations integrated with smart grid systems and energy storage solutions. (GlobeNewswire)

d) Keywords to weave (for SEO & B2B relevance)

Some of the relevant keywords to include: “EV charger solutions”, “EV charging infrastructure”, “public charging station”, “DC fast charger”, “AC charger for EV”, “charging network management”, “fleet charging”, “ev charger deployment Europe”, “Asia EV charger market”, “Latin America charging infrastructure”, “Middle East EV charger station”, “commercial EV charging”, “smart charging station”. Using these in context helps with search engine optimization and relevance for B2B queries.

3. Regional insights & strategic implications

Here we examine region by region, focusing on B2B vantage (manufacturers, infrastructure providers, service platforms) for Europe, South America, Asia (incl. Southeast Asia), Middle East, Russia / Central Asia.

Europe

- The European market is driven by strong regulation (e.g., Alternative Fuels Infrastructure Regulation (AFIR)) requiring public charging infrastructure coverage. For example, in Europe the number of fast chargers rose 55% in 2022, reaching nearly 70,000. (virta.global)

- From the EV charger equipment perspective: Europe held ~38% of the global chargers market share in 2024. (marketintelo.com)

- Key takeaway: High-maturity market, significant competition, emphasis on interoperability, standards (e.g., CCS, ISO 15118) and software/operation excellence.

- For B2B: Focus on value-added services (software, network operations), modular/hybrid installation models, fleet/depot charging, ultra-fast highway installations.

Asia & Southeast Asia

- Asia-Pacific is the fastest-growing region for EV charging. For example, the smart EV charger market in Asia-Pacific (2025) will hold ~42.3% of the global share. (Cognitive Market Research)

- Many emerging markets in Southeast Asia are still in early phases: infrastructure, regulation and grid readiness vary.

- For B2B: Opportunities for greenfield build-out, partnerships with OEMs, local manufacturing, bundled solutions (hardware+installation+software) and leveraging scale and cost-efficiencies.

Latin America (South America)

- The market is still small but growing fast: Latin America charging infrastructure revenue USD 203.6 million in 2024, CAGR ~20.7% from 2025-2030. (Grand View Research)

- South America’s share in EV chargers market ~7.1% in 2025. (Cognitive Market Research)

- For B2B: Key markets include Brazil (highest growth), Chile, Colombia. Challenges: grid infrastructure, financing, logistic costs. But less legacy charging infrastructure means less “brownfield” constraint — good for entrants.

Middle East & Russia / Central Asia

- Though data is sparser, the Middle East region is launching national EV charging frameworks; for example, some Gulf countries mandate EV charger installations in new commercial real-estate projects. (globalgrowthinsights.com)

- Russia and Central Asia have unique conditions: energy regimes, regulatory risk, less mature EV adoption — but potentially institutional/corporate clients (fleet, mining, logistics) that can adopt EV charging solutions.

- For B2B: Consider partnerships with local utility and infrastructure players, customize solutions for fleets (buses, logistics), adapt to extreme climate/geography, consider financing/leasing models.

4. Real data & table for reference

Here is a table summarising key data points relevant for B2B decision-making.

| Region | Metric | Value | Source |

|---|---|---|---|

| Europe | Share of global EV charger market (2024) | ~38% | (marketintelo.com) |

| Europe | Public chargers in 2022 | ~450,000 publicly available chargers | (virta.global) |

| Europe | Fast chargers in Europe end 2022 | ~70,000 units (55% growth from 2021) | |

| Latin America | Charging infrastructure revenue 2024 | USD 203.6 million | (Grand View Research) |

| Latin America | CAGR 2025-2030 | ~20.7% | (Grand View Research) |

| Asia-Pacific | Smart EV charger market share 2025 | ~42.3% | (Cognitive Market Research) |

| Global EV charger market | Revenue 2025 forecast | USD 18,496.5 million | (Cognitive Market Research) |

| Global charging station market | Size 2024 | USD 31.1 billion |

Interpretation: These numbers help B2B strategy: Europe is already large and somewhat crowded; Latin America offers growth but lower base; Asia offers scale and rapid growth; Middle East/Central Asia less defined but potential for strategic early-moves.

5. Key business considerations & tips for B2B success

When you are planning to deploy or supply EV chargers (or broader charging infrastructure), especially across multiple regions (Europe, South America, Asia, Middle East, Russia/Central Asia), keep the following in mind.

Tip 1: Understand local regulatory and grid-infrastructure context

- In Europe, standards (e.g., plug types, payment/interop, AFIR regulation) matter.

- In emerging markets, grid capacity, utility tariffs, subsidy programmes, land/permits can be major bottlenecks.

- For example, in Southeast Asia the literature on Vietnam optimisation of charging-station placement highlights the importance of operational cost, rental cost, waiting cost, travel cost and installation cost in planning. (arXiv)

Tip 2: Choose the right product mix: AC vs DC, modular vs scalable

- For urban commercial/residential deployments: AC chargers may suffice and are lower cost.

- For highway / fleet / logistics applications: DC fast chargers (or ultra-fast) are required. Offering modular scalable systems helps.

- Services and software (charging-network management, payment integration, load-management) increasingly differentiate.

Tip 3: Localised manufacturing / supply chain advantages

- In Asia especially many countries aim to localise manufacturing of EV charger equipment and cables (see Asia-Pacific smart charger market growth). (Cognitive Market Research)

- Tariffs, shipping, maintenance logistics in Latin America/Middle-East may favour local/regional manufacture or assembly.

Tip 4: Business models and financing matters

- B2B clients (fleet operators, property developers, shopping malls, airports) often prefer “charging-as-a-service” or leasing models rather than heavy upfront capex.

- In emerging markets where regulatory or power supply risk is higher, structuring partnerships with utilities or governments can de-risk the project.

- Consider uptime guarantees, service contracts and usage monitoring – crucial for commercial viability.

Tip 5: Focus on interoperability, software & future-proofing

- As charger counts grow, network management, data analytics, remote monitoring, firmware updates become important.

- B2B customers will increasingly expect higher-level services: load-management, demand-response, integration with renewables/storage.

- For example, one academic study on charging stations security pointed out that many deployed CCS DC charging stations still lack robust TLS security, raising concerns on future network reliability. (arXiv)

Tip 6: Scalability across geographies

- Given your target regions (Europe, South America, Asia, Southeast Asia, Middle East, Russia / Central Asia), you’ll want a product & partner strategy that adapts to local voltage/grid/regulation differences, currency risk, language/localisation, installer networks and after-sales support.

- Think globally but localise smartly – local partners, local service crews, local regulatory roadmap.

6. Outlook: What to expect & where the runway is

- Growth will continue: both charger units and infrastructure installations will scale rapidly across the regions mentioned.

- In Europe, given the regulatory push and mature market, differentiation will come from value-added services (software, O&M, integration) rather than hardware alone.

- In Asia & Southeast Asia, both hardware scale and software/installation will expand strongly: large urbanisation, strong EV growth, many “greenfield” opportunities.

- In Latin America and Middle East / Central Asia: slower base but high growth potential; those who move early may capture market share and become local leaders.

- Technological advances (ultra-fast charging, smart grid integration, vehicle-to-grid (V2G) compatibility) and business model shifts (charging subscription, dynamic pricing, fleet-charging) will shape the next wave of the EV charger market.

7. Conclusion

For B2B stakeholders aiming to engage in the EV charger ecosystem, the message is clear:

- The market opportunity is real, large, และ global — including Europe, South America, Asia/Southeast Asia, Middle East and Russia/Central Asia.

- Success will depend not just on manufacturing the EV charger hardware, but on delivering complete solutions — installation, network management, service contracts, integration.

- Regional strategies must adapt to local conditions (regulation, infrastructure, business model) but share global vision.

- Those who act now, build partnerships, localise operations, and invest in software/operations differentiation will likely capture the value in this next-wave infrastructure build-out.