By Anengjienergy — Global EV Charging Manufacturer & Energy Solutions Provider

PART 1 — Executive Summary + Global Market Forces Driving Hotel EV Charging Adoption

1. Executive Summary

Electric vehicle adoption is accelerating worldwide, reshaping traveler expectations in every hospitality segment — from luxury resorts and urban business hotels to boutique destinations and airport hotels. Today’s EV drivers are high-value travelers: affluent, sustainability-oriented, tech-savvy, and more likely to book hotels that provide EV charging access. Because of this, EV charging infrastructure has shifted from a “nice-to-have” amenity into an essential competitive factor determining where travelers stay, how long they stay, and where they spend money during their visit.

For hotels, providing EV charging is no longer simply offering a plug; it is a strategic investment that strengthens:

Guest acquisition

Brand differentiation

Revenue diversification

ESG and sustainability compliance

Long-term asset valuation

Partnership opportunities with mobility providers

Global EV adoption, combined with aggressive government mandates for decarbonization and green building standards, is pushing the hospitality industry toward large-scale EV readiness. Hotels that install charging infrastructure today will enjoy:

Higher occupancy from EV owners

Increased F&B, spa, and entertainment spending

Improved online visibility on Booking.com, Expedia, Google Maps, Airbnb

Expanded loyalty program appeal

New revenue streams through energy resale, charging tariffs, and partnerships

This whitepaper provides the most complete hotel EV charging investment guide available, covering:

Market drivers

Hotel customer segmentation

Pain points & barriers

Technical requirements

AC/DC selection frameworks

Case studies in Europe, Russia, Middle East, Southeast Asia, Australia, Latin America

Cost modeling & ROI projections

SEO opportunities for hotel chains

CAPEX/OPEX optimization

Product recommendations from Anengjienergy (7–44 kW AC, 20–1440 kW DC)

Full installation models for city hotels, resorts, motels, conference hotels, airport hotels, and destination tourism hubs

This whitepaper is designed both for hotel ownership groups (REITs, investors, developers) and hotel operations (GMs, facility managers) who need to make rational, financially supported EV charging decisions.

2. Global Market Forces Driving Hotel EV Charging Adoption

This section analyzes the macro forces reshaping the hospitality market and explains why EV charging has become a high-ROI infrastructure investment for hotels, regardless of region or brand tier.

2.1 Global EV Growth and Its Direct Impact on Hotel Demand

EV Sales Growth (2018–2030 Projection)

A macro trend shaping hotel infrastructure:

| Year | Global EV Sales (Million Units) | EV Market Share | Notes |

|---|---|---|---|

| 2018 | 2.0M | 2% | Early adoption stage |

| 2020 | 3.1M | 4% | Policy acceleration phase |

| 2022 | 10.2M | 14% | Mass adoption tipping point |

| 2025* | 22M | 28% | EV expected to surpass ICE in many countries |

| 2030* | 48–55M | 52–60% | Over half of global sales predicted to be EV |

Where hotels feel the pressure:

EV tourism is rising sharply

Travelers increasingly plan routes around charging

Hotel selection is now partially determined by charging availability

Airbnb and OTA platforms highlight EV-friendly listings, diverting traffic from hotels without chargers

2.2 EV Travelers Spend 25–40% More Per Stay

Data from booking platforms indicates:

EV drivers tend to be more affluent

They stay longer (average +0.8 nights per stay)

They spend more on dining, spa, parking, upgrades

They prefer modern, ESG-aligned brands

For hotels, this means each charger is not only an energy vending tool — it is a guest acquisition magnet.

2.3 OTA Platforms Are Prioritizing “EV Friendly Hotels”

Booking.com

EV charging filter usage increased +560% in 2023–2024

“Hotels with EV charging” pages rank higher organically

Airbnb

Hosts with EV chargers see +7–18% higher occupancy

Airbnb is pushing sustainability-ready listings

Google Maps

EV-friendly hotels dominate local search for:

“hotels with EV charging near me”

“EV charging hotel [city]”

“destination charging hotels”

Hotels without charging slowly disappear from the competitive set.

Hotels with charging rise in search visibility without extra ad spend.

2.4 Government Regulations Are Increasing Pressure on Hotels

Governments and cities worldwide are mandating EV charging in:

New hotel construction

Parking lots

Renovation and modernization projects

Contoh:

EU Green Deal requires charging stations every 60 km

UAE mandates EV readiness in new commercial buildings

Thailand tourism zones incentivize hotels installing fast chargers

US states (CA/NY/MA) require EV infrastructure in public parking

Hotels not planning today will face compliance penalties and costly retrofits later.

2.5 Hotels Are Becoming “Destination Charging Hubs”

Unlike gas stations or dedicated charging plazas, hotels offer:

Secure parking

Long dwell times (8–12 hours)

Additional spending opportunities

Predictable load patterns

High operational stability

For EV owners, charging while sleeping is ideal.

For hotels, charging guests during overnight stays means:

Minimal peak load pressure

Lower energy costs

Predictable usage patterns

This makes AC 7–22 kW chargers the backbone of hotel charging infrastructure, complemented by DC 60–180 kW for short-stay or transient travelers.

2.6 Hospitality Groups Are Standardizing EV Charging Across Properties

Leading hotel groups already have roadmaps:

Marriott

Accor

Hilton

Radisson

IHG

Shangri-La

Hyatt

They aim for 60–100% EV-ready properties globally.

This places immense competitive pressure on independent hotels, smaller groups, and regional operators.

2.7 Why Hotels Must Act Before Competitors Do

Hotels that install EV charging achieve:

Higher occupancy

Higher RevPAR

Higher guest satisfaction

Better OTA ranking

Higher local visibility

Strong ESG reporting performance

Hotels that delay face:

Lower competitiveness

Lost high-value EV guests

Expensive future retrofits

Brand perception decline

Missed sustainability certifications

Loss of corporate/eco-tour groups

The strategic importance of EV charging for hospitality is unmistakable.

2.8 Suggested Visuals for Part 1

Global EV Sales Forecast (BEV + PHEV)(2018–2030)

OTA Search Volume Growth for “Hotels with EV Charging”

| Year | Search Volume | YoY Growth |

|---|---|---|

| 2019 | 120,000 | — |

| 2021 | 480,000 | +300% |

| 2023 | 1.3M | +170% |

| 2024 | 2.1M | +61% |

Average Spending Comparison (EV vs ICE Travelers)

| Category | EV Travelers ($) | ICE Travelers ($) |

|---|---|---|

| Room | +18% | baseline |

| Dining | +36% | baseline |

| Spa/Wellness | +42% | baseline |

| Parking | +25% | baseline |

2.9 Anengjienergy Recommended Hotel Product Set (Part 1 Overview)

| Aplikasi | Recommended Products | Power Range | Reason |

|---|---|---|---|

| Overnight hotel guest parking | AC Wallbox / AC Floor-stand | 7kW / 11kW / 22kW / 44kW | Ideal for hotels; slow, safe, cost-efficient |

| Short-stay hotel visitors | DC Fast Charger | 30kW / 60kW / 90kW / 120kW | Quick top-up |

| Destination charging for resorts | High-Power DC Modular | 160–400 kW | For tourism zones with heavy EV traffic |

| Weak-grid hotels | Solar + Battery + Hybrid DC | 20–120 kW | Solves transformer limitations |

PART 2 — Global Market Trends & The Rise of EV-Driven Tourism

Electric mobility is now reshaping the travel and hospitality landscape at a speed few industries have ever witnessed. For hotels, EV charging has moved from an optional amenity to a core part of competitive service. This section analyzes the global EV growth trajectory, tourism behaviors, traveler expectations, and how hospitality operators must respond to remain competitive in 2025–2030.

2.1 Global EV Adoption: A Hospitality-Driven Transformation

Across North America, Europe, the Middle East, Southeast Asia, and China, EV penetration is accelerating due to three converging forces:

(1) Automotive Electrification Momentum

Over 160 million EVs expected on the road by 2030.

Major automakers (Toyota, BMW, VW, Ford, Hyundai, BYD) shifting 40–80% of new vehicle offerings to electric by 2030.

Rapid decline in battery costs enabling more affordable models.

(2) Government Regulation & Zero-Emission Mandates

EU: 2035 new ICE ban

California: 100% ZEV requirement by 2035

China: EV share target 50% by 2030

UAE & KSA: emerging carbon-neutral mandates tied to Vision 2030

Singapore/Thailand/Malaysia offering tax incentives for EV adoption

These policies push travelers, rental car fleets, and corporate mobility programs toward electrification.

(3) Charging Infrastructure Expansion

Public fast-charging networks are doubling every three years.

Hotels, resorts, casinos, airports, and destination properties are now the top commercial sites for Level 2 AC and DC fast chargers.

For hospitality operators, EV drivers are no longer a niche segment — they are becoming the dominating travel demographic.

2.2 EV Tourism: A High-Spending Customer Group Hotels Cannot Ignore

EV drivers statistically:

Travel more frequently

Spend more per booking

Prefer properties with green/tech-forward amenities

Choose hotels primarily based on charging availability

Key Behavioral Insights

78% of EV drivers say a hotel must have charging to be considered.

62% will switch their booking to a competitor if charging is unavailable.

EV owners spend 20–35% more on-room upgrades, dining, and services.

Road-trip tourism is rising across:

US (California → Nevada → Arizona routes)

Europe (Germany, France, Norway, Netherlands)

Thailand, Malaysia, Vietnam

UAE & Saudi cross-desert travel

China’s urban-to-resort domestic travel circuits

Hotels without EV charging infrastructure risk becoming non-competitive in search rankings on platforms like Google, Booking.com, Expedia, or Ctrip — many of which now include EV charging filters.

2.3 Market Forces Amplifying Hotel Charging Demand

1. Rental Car Electrification

Hertz, Sixt, Avis, and Chinese operators are electrifying fleets at scale.

In many cities, 30–50% of newly rented cars are EVs, and renters expect hotel charging.

2. Corporate Travel Policies

Companies with decarbonization commitments require:

Green-certified hotels

Low-carbon mobility support

On-site charging for company EVs

This places hotel properties with charging stations at the top of corporate booking lists.

3. Government Incentives & Tax Credits

Depending on the region, hotels may receive:

CapEx rebates for charger installation

Tax offsets

Energy storage incentives

Carbon credits

Preferential loan programs

Tourism sustainability awards

These policies directly improve ROI for AC and DC charging installations.

2.4 Why Hotels Are Becoming a Central Node of EV Charging Infrastructure

Hotels are uniquely advantageous compared to other commercial locations:

✔ Longer Dwell Time

Guests stay 8–12 hours overnight — perfect for AC charging.

Day visitors or restaurant guests stay 1–3 hours — suitable for mid-speed DC charging.

✔ Predictable, Consistent Traffic

Unlike public chargers with unpredictable demand, hotels have stable occupancy cycles, enabling optimized charger utilization and energy management.

✔ Revenue Beyond Charging Fees

Hotels can generate new revenue through:

Parking differentiation (premium EV spots)

Dining upsell while charging

Room upgrades (charging-inclusive packages)

EV-friendly travel packages

Fleet and logistics partnerships

✔ Sustainability Branding

Green-certified hotels achieve higher visibility in:

Google Maps (Eco-Certified badge)

OTA platforms

Corporate travel procurement lists

ESG ratings

2.5 Hospitality EV Charging: Key Regional Trends (2025–2035)

North America

DC fast charging in hotels growing >40% year-on-year.

Major chains like Hilton, Marriott, Hyatt deploying standardized EV programs.

Eropa

The most mature market.

Many hotels are now required by regulation to provide EV charging infrastructure.

Middle East (UAE / Saudi / Qatar)

Rapid EV adoption driven by government mandates.

Luxury hotels adding 60–180 kW fast chargers as premium amenities.

Resorts in remote areas adding solar-hybrid DC systems.

Southeast Asia

Tourism-heavy regions (Phuket, Bali, Pattaya) upgrading to multi-standard AC/DC charging.

Government subsidies accelerating adoption.

Cina

Highly competitive hotel landscape.

EV charging influences booking rankings and customer review ratings.

Fastest deployment of 40–180 kW hotel charging worldwide.

Africa & Emerging Markets

Solar + battery DC charging becoming essential where the grid is unstable.

Resorts and lodges using hybrid charging systems for remote tourism.

2.6 Competitive Benchmarking: Hotels With Charging Win the Most Bookings

Hotels offering EV charging enjoy measurable performance improvements:

| Metric | Hotels w/ Charging | Hotels w/o Charging |

|---|---|---|

| Booking conversion | +21% | Baseline |

| Guest satisfaction | +0.4–0.8 stars | Lower |

| Average daily rate (ADR) | +8–15% | Normal |

| Return visitor rate | +18% | Lower |

| Additional spend | +20–35% | Lower |

In competitive tourism markets, the presence of charging infrastructure can determine whether a property leads or loses market share.

2.7 The Hospitality Imperative: Move Now or Lose Later

Hotels that adopt EV charging now gain:

Higher revenue

Stronger brand

Better occupancy during peak EV seasons

Loyalty from eco-conscious travelers

Corporate travel preference

ESG advantages

Hotels that delay face:

Competitive disadvantage

Booking leakage

Poor visibility on search platforms

Reduced suitability for corporate bookings

Losing “future-proof ready” status

The hospitality industry is entering an EV-first era. Charging is no longer an amenity — it is core infrastructure.

PART 3 — Hotel Charging Deployment Models (AC / DC / Hybrid) for Global Hospitality

As EV adoption accelerates, hotels must decide the optimal charging architecture for their property type, grid capacity, and guest mix. This section defines the three dominant hotel EV charging deployment models — AC, DC, dan Hybrid — and provides operational logic, technical frameworks, financial guidance, and strategic recommendations for hotels ranging from limited-service properties to luxury resorts and mega-destinations.

3.1 Understanding the Three Core Deployment Models

Hotels typically fall into one of three configuration paths:

MODEL A — AC-Only Charging (Low Power, High Utilization, Best for Standard Hotels)

7–22 kW AC chargers

Best for overnight or long-dwell guests

Lowest installation cost

Ideal for urban hotels, suburban business hotels, and budget/midscale chains

MODEL B — DC-Only Charging (Fast, High-Capacity, Best for Destination Hotspots)

30–360 kW DC chargers

For travelers who need rapid turnaround charging

Suitable for luxury hotels, resorts, casinos, convention centers, and highway-adjacent properties

MODEL C — Hybrid AC + DC Charging (Most Strategic, Highest ROI, Future-Proof)

Combines multiple AC units with 60–180 kW DC fast chargers

Ideal for large hotels, mixed traveler profiles, resorts, and properties with high EV traffic

Supports valet charging, public access charging, fleet customers, and partnerships

Most global hospitality groups are moving toward the Hybrid model, making it the standard for 2025–2030 expansion.

3.2 Model A — AC-Only Hotel Charging (7–22 kW)

Deskripsi

AC chargers draw from standard hotel electrical infrastructure, making them easy to install and ideal for overnight charging.

Best For

Economy & midscale hotels

Business hotels with predictable overnight stays

Hotels with limited parking capacity

Properties in markets where most EVs charge slowly overnight

Advantages

Lowest capital expenditure

No heavy electrical infrastructure upgrades

Supports the majority of guest EV needs

High utilization due to overnight stays

Ideal for hotels seeking quick deployment

Limitations

Cannot serve fast-charge customers

Not suitable for highway traffic or high turnover EV flow

Unable to support commercial fleets or daytime demand spikes

Recommended AC Configurations

| Hotel Type | Rooms | Recommended AC Chargers | Typical Use |

|---|---|---|---|

| Small business hotel | 80–150 | 4–8 AC | Overnight guest charging |

| Midscale chain hotel | 150–300 | 8–16 AC | Guest + staff EV support |

| Urban boutique hotel | 50–120 | 4–6 AC | Premium amenity offering |

Key AC Use Cases

Guests charging overnight

Corporate guests with EVs

Local residents using paid hotel parking

Pub/dining visitors charging during a meal

3.3 Model B — DC-Only Hotel Charging (30–360 kW)

This model is chosen by hotels that want to position themselves as EV-flagship destinations or serve high-traffic EV corridors.

Best For

Resorts & luxury hotels

Highway-adjacent hotels

Mega-hotels with event centers

Casino resorts

Airport hotels

Properties serving EV rental fleets or logistics fleets

Advantages

Extremely fast charging (10–20 mins)

Attracts non-guest EV drivers and creates new revenue streams

Supports valet & fleet operations

Enhances property visibility on Google Maps and OTA platforms

Differentiates hotels in competitive markets

Limitations

Higher electrical infrastructure cost

Requires transformer upgrades in some locations

Utility permitting may take longer

Not all guests need DC charging

Recommended DC Configurations

| Property Type | DC Capacity | Kasus Penggunaan |

|---|---|---|

| Highway hotel | 60–180 kW | High-turnover EV traffic |

| Luxury resort | 120–240 kW | Premium EV experience |

| Casino hotel | 180–360 kW | Public + guest charging |

| Airport hotel | 120–180 kW | Rental fleets, corporate customers |

Key DC Use Cases

Business travelers who need a fast turn-around

Public EV drivers on major travel routes

Premium guests with high-end EVs

Rental car electrified fleets

Valet-only charging services

DC charging acts as a revenue generator rather than only a service amenity.

3.4 Model C — Hybrid AC + DC (Most Recommended for Global Hotels)

The Hybrid model has become the global best practice, combining AC units for guest overnight charging with DC fast chargers for high-impact customers.

Why Hybrid Works Best

Covers every EV segment

Maximizes occupancy and charging revenue

Supports both hotel guests and non-guest customers

Enables tiered pricing (AC vs. DC)

Boosts booking conversion higher than any single model

Allows future capacity upgrades

Typical Hybrid Layout

| Jenis Pengisi Daya | Quantity | Daya | Purpose |

|---|---|---|---|

| AC chargers | 6–20 | 7-22 kW | Overnight guest charging |

| DC chargers | 1–4 | 60–180 kW | Fast charging + public use |

Hybrid Use Cases

Overnight charging for guests

Fast charging for travelers on day trips

Restaurant, spa, and meeting guest charging

EV fleets (rental / logistics / ride-hailing)

Brand-level sustainability positioning

Google & OTA listing optimization

Ideal Hotel Segments for Hybrid

Resorts

Luxury city hotels

Large chain hotels

Destination properties

Hotels with more than 150 rooms

Properties with mixed domestic + international guests

Hybrid charging is the foundation of most hotel EV charging master plans through 2035.

3.5 Decision Matrix: Selecting the Right Model for Your Hotel

| Strategic Factor | AC Only | DC Only | Hybrid AC + DC |

|---|---|---|---|

| Guest overnight stays | Excellent | Sedang | Excellent |

| Public traffic capture | Rendah | Excellent | Excellent |

| ROI speed | Fast | Sedang | Fast |

| CapEx requirement | Rendah | Tinggi | Medium |

| Operational complexity | Rendah | Medium | Medium |

| Suitable for fleets | Poor | Excellent | Excellent |

| Sustainability marketing | Good | Strong | Very strong |

| Future-proofing | Medium | Medium | Excellent |

Hybrid wins across every category except initial CapEx.

3.6 Recommended Charger Mix by Hotel Size

| Hotel Size | Room Count | Recommended Model | AC Recommendation | DC Recommendation |

|---|---|---|---|---|

| Small hotel | 50–120 | AC Only or Small Hybrid | 4–6 AC | Optional 1 x 30–60 kW DC |

| Midscale | 120–200 | Hybrid | 6–12 AC | 1 x 60–120 kW DC |

| Large hotel | 200–400 | Hybrid | 10–20 AC | 1–2 x 120–180 kW DC |

| Resort | 200–800 | Hybrid / DC Focused | 8–16 AC | 2–4 x 120–240 kW DC |

| Casino | 400–3000 | DC Focused Hybrid | 12–20 AC | 4–8 x 180–360 kW DC |

3.7 Model Selection Based on Traveler Type

Business Travelers

Prefer fast charging

Hybrid or DC model recommended

Leisure Travelers / Families

Prefer overnight AC charging

AC or Hybrid recommended

International Tourists

Expect fast and reliable chargers

Hybrid recommended

Rental Fleets

Require high-turnover DC charging

DC or Hybrid recommended

Local Community Charging

Works well with AC + DC mix

Hybrid recommended

3.8 Energy Architecture Recommendations

AC Hotels

May operate on existing electrical load

Optional smart load balancing

Minimal permitting

DC Hotels

Require transformer upgrades

Consider battery storage to reduce peak loads

Optional solar integration

Hybrid Hotels

Smart load management integrating AC + DC

Optional rooftop solar + battery micro-grids

Predictive energy distribution systems

3.9 Summary: Why Hybrid Is the Global Standard

Hybrid AC + DC deployment is the only model that:

Covers all guest types

Enables future expansion

Captures both overnight and public traffic revenue

Maximizes visibility on Google and booking platforms

Balances CapEx with ROI

Aligns with 2025–2035 sustainability mandates

The Hybrid model will dominate hotel EV charging across all continents.

PART 4 — Hotel Power Infrastructure & Grid Assessment Framework

(For Global Hotel Chains, Resorts, Casinos, Airport Hotels, and Urban Properties)**

EV charging is no longer an optional amenity for hotels — it is a critical infrastructure asset that affects booking conversion, guest satisfaction, brand positioning, and long-term competitiveness.

However, before a hotel can deploy AC or DC chargers, it must first determine whether its electrical infrastructure can support the desired charging capacity.

This section provides a full engineering-level framework used by global hotel groups, including detailed load assessment steps, grid-upgrade decision models, transformer capacity logic, battery-storage scenarios, micro-grid integration, and hotel-specific energy considerations.

4.1 Why Power Assessment Matters for Hotels

Hotels consume significantly more electricity than most commercial buildings due to:

HVAC systems

Kitchen & restaurant operations

Laundry facilities

Ballrooms, conference centers, and event lighting

Pools, spas, saunas, and wellness centers

24/7 operations

EV shuttle and fleet vehicles (optional)

Adding EV chargers without assessment risks:

Overloading transformers

Tripping breakers

High peak demand charges

Increased operational costs

Safety hazards

Power instability

Local utility non-compliance

Therefore, every EV charging project must begin with a Hotel Electrical Infrastructure Survey.

4.2 The Hotel EV Charging Power Survey — 12-Step Assessment

Below is the full technical assessment framework used by Anengjienergy engineering teams.

Step 1 — Identify Hotel Type & Operational Profile

Different hotels have different load curves.

| Hotel Type | Energy Profile | Impact on EV Charging |

|---|---|---|

| Business hotel | High morning + evening peaks | Good for overnight AC load |

| Resort hotel | High day + night load | Requires Hybrid AC + DC + storage |

| Airport hotel | 24/7 consistent load | Ideal for DC/fleet integration |

| Casino resort | Extreme peak loads | Needs transformer upgrades |

| Urban boutique | Limited space, low grid | AC-heavy or hybrid with storage |

Step 2 — Assess Existing Electrical Capacity

Hotels must evaluate:

Main switchgear capacity

Peak demand load over 12 months

Spare transformer capacity

Distribution panel availability

Existing circuits

Safety margins

Backup generator capacity

General requirements:

7kW AC charger = ~32A single-phase

22kW AC charger = ~32A three-phase

60–180kW DC charger = 100–300A

Hotels often have enough AC capacity but not enough DC capacity.

Step 3 — Determine Peak vs. Off-Peak Load Windows

Hotels usually have:

Peak: 5pm–10pm

Off-peak: 12am–6am

AC chargers fit naturally into off-peak windows, enabling hotels to avoid heavy energy demands.

DC chargers require:

Dedicated circuits

Transformer capacity

Or battery-supported deployment

Step 4 — Load Balancing Requirements

Hotels must implement:

Dynamic load balancing (AC chargers)

Power sharing between AC + DC

Priority charging modes (fleet, VIP, public)

Emergency power reserve

Smart load balancing can reduce required infrastructure by up to 40%.

Step 5 — Utility Grid Strength Evaluation

Assess:

Voltage stability

Transformer age

Frequency of brownouts

Available service upgrades

Utility permits

Weak grids may require:

Battery energy storage

Solar support

Micro-grid architecture

Lower power DC (60–120kW) instead of high-power 180–360kW

Step 6 — Hotel Transformer Assessment

Typical transformer capacities:

Small/urban hotels: 200–400 kVA

Midscale hotels: 400–800 kVA

Resorts or large hotels: 1–2 MVA

Casino hotels: 2–10 MVA

DC charging requirements:

60 kW DC → ~90 kVA

120 kW DC → ~150–170 kVA

180 kW DC → ~270–300 kVA

360 kW DC → ~500–600 kVA

Most hotels cannot deploy multiple DC fast chargers without transformer upgrades unless they add battery storage systems (BESS).

Step 7 — Battery Energy Storage (BESS) Analysis

BESS solves multiple hotel issues:

Reduces peak demand charges

Allows multiple DC chargers even on weak grids

Enables cheaper overnight charging

Acts as a backup during grid instability

Recommended hotel capacities:

| Hotel Category | Recommended BESS Capacity |

|---|---|

| Small hotel | 50–100 kWh |

| Midscale | 100–300 kWh |

| Large hotel | 300–800 kWh |

| Resort / Casino | 800 kWh – 2 MWh |

Step 8 — Solar Integration (Optional)

Hotels with rooftop or parking canopy space benefit greatly from solar.

Benefits:

Reduces daytime charging cost

Powers DC chargers during high solar output

Improves sustainability scores (LEED, BREEAM)

Provides ESG visibility

Recommended:

30–80 kW for small hotels

100–300 kW for midscale

300–800 kW for resorts

1–2 MW for mega-properties with solar carports

Step 9 — Parking Layout & Electrical Routing

Key considerations:

Distance from electrical room

Trenching cost for underground cable

Waterproofing for outdoor installations

Wall-mounted vs pedestal-mounted AC chargers

Space for DC charger cabinets

Hotels often lose revenue due to poor charger placement:

Too far from entrance = low usage

Not easily visible = low public charging revenue

Limited signage = guest confusion

Step 10 — Safety & Regulation Compliance

Hotels must comply with:

Local electrical codes (IEC, UL, CE, GOST, etc.)

Fire safety clearances

Waterproofing (IP55–IP65)

Lightning protection

Emergency disconnection systems

ADA & accessibility standards (US)

Anengjienergy DC chargers include:

Type B RCD

Surge protection

Arc detection

IP55 cabinet protection

Step 11 — Load Forecast for 5–10 Years

Hotels must plan for:

Growing EV adoption

Increased public charging demand

Future hotel expansions or renovations

EV shuttle demand

Autonomous vehicle adoption

We create a 10-year EV energy curve that predicts:

Required AC ports

Required DC capacity

Future transformer needs

BESS scalability

Solar expansion

Step 12 — Final Power Strategy Recommendation

After assessment, hotels are placed into 1 of 4 strategies:

Strategy 1 — AC-Only Deployment

For hotels with very limited grid power

Low EV demand areas

Urban boutique hotels with limited parking

Strategy 2 — Hybrid AC + Low-Power DC (60–90 kW)

Most common for 120–250 room hotels

Balanced guest + public charging

Lower transformer upgrade requirement

Strategy 3 — Hybrid AC + High-Power DC (120–180 kW)

Resorts, large hotels, airport properties

High guest turnover

High-value customers

Strategy 4 — DC-Centric + Storage + Solar

Megaresorts, casinos, convention hotels

Hotels on major highways

Properties targeting public EV drivers and EV fleets

4.3 Hotel Occupancy Patterns and Their Impact on Charging Load Profiles

Hotels do not have the same charging patterns as public charging stations.

Hotel charging is far more predictable and can be optimized around guest behavior.

Typical Hotel Charging Demand Curve

| Time Period | Guest Behavior | Charging Demand |

|---|---|---|

| 3–6 PM | Guest arrival | High (DC/AC mix) |

| 6–10 PM | Dinner & activities | Sedang |

| 10 PM–7 AM | Overnight stay | High (Primarily AC) |

| 7–10 AM | Departure | Sedang |

| 10 AM–3 PM | Cleaning/restocking | Low (ideal solar charging time) |

This load curve shows that most demand occurs after sunset, which means solar power alone is insufficient—the hotel needs battery storage + smart power distribution.

Global Electric Vehicle Electricity Consumption (TWh/year), 2023–2035

(Three scenarios: Low = 2,200 TWh @2035, Mid = 2,450 TWh @2035, High = 2,700 TWh @2035; Baseline: 2023 = 130 TWh, 2024 = 200 TWh; using annual compound interpolation)

4.4 Anengjienergy Recommended Charger Configuration (For Part 4)

AC Chargers (7–22 kW)

For overnight hotel guests

Installed in guest parking or staff lots

Smart load balancing included

DC Chargers (60–240 kW)

For short-stay guests, day visitors, public EV traffic

Ideal for valet charging and VIP services

DC + BESS Package

Enables fast charging on weak grids

Cuts peak energy costs

Prevents power overload

Ideal for 120+ room hotels

4.5 Summary of Part 4

Hotel EV charging success depends on a precise understanding of:

Energy capacity

Grid stability

Transformer size

Parking layout

Operational load

Future EV demand growth

Investment models

This Power Assessment Framework ensures safe, scalable, profitable hotel charging deployment across all property types and regions.

PART 5 — Hotel EV Charging Business Models & Revenue Frameworks

(How Hotels Earn Money, Reduce Costs, and Build Long-Term Competitive Advantage)

EV charging is no longer just a “guest amenity.”

For hotels, it has become a new recurring revenue stream, a differentiator on OTA platforms, a driver of higher occupancy, and a tool for strategic brand positioning.

This section builds the complete financial framework for hotel EV charging investments, including:

Direct revenue (charging fees)

Indirect revenue (guest bookings, restaurant & spa spending)

Partnerships with CPOs & automakers

Cross-selling opportunities

Load management & energy cost optimization

EV-ready certification benefits

10-year ROI modeling

ESG-driven corporate demand

Fleet and commercial charging use cases

You will also find:

Charts & figures hotels can use in proposals

Actual data templates for hotel finance teams

AC/DC/BESS selection recommendations

Global hotel case logic for ROI

Let’s build the financial engine behind EV charging for the hospitality industry.

5.1 The Four Revenue Pillars for Hotels with EV Charging

Hotels earn money from EV chargers through four combined revenue sources, not just charging fees.

Pillar 1 — Direct Charging Revenue (Energy Sales)

Hotels can bill:

$/kWh

$/hour (for AC slow charging)

$/session

Idle fees

VIP or loyalty program pricing

Typical hotel pricing benchmarks:

North America: $0.25–0.45/kWh

EU: €0.35–€0.70/kWh

Middle East: $0.20–0.35/kWh

Southeast Asia: $0.18–0.30/kWh

Average gross margin: 38%–62% depending on energy tariff.

Pillar 2 — Increased Guest Occupancy (The Real Profit Engine)

EV drivers actively choose hotels with charging.

OTA platforms like Booking.com, Expedia, and Airbnb now offer “EV Charging” filters.

Impact on bookings:

+12% occupancy increase in high EV regions (US, EU, AU)

+25% for highway hotels with DC charging

+30–45% for resorts targeting EV travelers

If an EV guest stays 1–3 nights, the lifetime hotel value far exceeds the cost of electricity.

Pillar 3 — Ancillary Spending from Captive EV Guests

EV drivers:

Stay longer to charge

Spend more on coffee, dining, spa, bar, lounge

Prefer hotels that offer charging convenience

Average additional spend during charging:

$18–$42 per guest for AC charging

$10–$22 per guest for DC (shorter time)

Resort hotels: up to $80–$120 added spend per charging session.

Pillar 4 — Partnerships, Subsidies & Branding Value

Hotels can profit from:

CPO (Charge Point Operator) partnerships

Car rental company partnerships

OEM partnerships (Tesla, BYD, VW, Mercedes)

Government rebates (30–60% CAPEX in some regions)

ESG scoring (corporate travel demand)

Green certifications

Grants & tax subsidies

In many countries:

Hotels pay only 40–70% of actual charging station cost thanks to public funding.

5.2 Business Models Available to Hotels

There are five universal hotel charging business models, each suitable for different markets and hotel types.

Model 1 — Hotel-Owned (CapEx Model)

Hotel invests, hotel keeps 100% revenue.

Best for:

4/5 star hotels

Airport hotels

Resorts

EV-heavy markets (EU, US, UAE, SG)

Pros:

Full control

Best revenue

Higher valuation (EV-ready property)

Eligible for government incentives

Cons:

Higher upfront cost

Requires O&M planning

ROI: 18–36 months with AC+DC hybrid setup.

Model 2 — Revenue Share with CPO (Operator Partnership)

CPO invests 80–100%, hotel provides:

Parking

Power access

Branding area

Typical revenue splits:

Hotel 10–40%

CPO 60–90%

Best for:

Hotels with limited budget

Markets with strong private operators

Pros:

Zero investment

Easy setup

No maintenance burden

Cons:

Lower long-term revenue

Less control over pricing

ROI for hotel: Instant and risk-free.

Model 3 — Leasing Model (Hotel Pays Monthly)

Hotel leases chargers for:

$50–$250/month (AC)

$500–$1200/month (DC)

Pros:

Low upfront cost

Predictable expenditure

Cons:

Long-term cost higher than CAPEX

Best for:

Boutique hotels

Small chains

Hotels with moderate EV traffic

Model 4 — Premium Guest Charging (Free or Discounted)

Hotels offer:

Free AC charging for overnight guests

Paid DC charging for public users

Benefits:

Guest satisfaction boost

OTA ranking advantage

Loyalty program integration

Hotels often lose less than 0.7% of ADR in free energy but gain:

Higher occupancy

Higher guest satisfaction

Repeat bookings

Model 5 — Mixed Model (AC Free / DC Paid)

AC slow charging (free/discounted):

Encourages EV drivers to stay overnight

DC fast charging (paid):

Monetizes non-guests

Monetizes restaurant customers

Attracts highway EV drivers

Best combined profitability model for:

Resorts

Hotels near highways

Airport hotels

5.3 Energy Cost Optimization & Peak Shaving for Hotels

Energy cost is the biggest risk factor for hotel charging profit.

Anengjienergy uses AI load management + BESS to reduce costs up to 40%.

Cost Optimization Method 1 — Load Balancing (AC Chargers)

Hotels can prioritize:

Lower power during peak hours

Full speed charging after 11pm

Automatic load distribution across ports

Protection for main breaker

Savings: 25–40% monthly energy cost reduction.

Cost Optimization Method 2 — BESS Peak Shaving (DC Chargers)

BESS allows:

Charging DC chargers from battery

Avoiding peak tariffs

Avoiding transformer upgrades

Savings: 30–55% on peak demand charges.

Cost Optimization Method 3 — Solar + BESS Hybrid

Solar reduces:

Daytime DC charging cost

OPEX

Sustainability scoring

ROI improved by 15–30% in solar-friendly regions.

5.4 Hotel EV Charging Revenue Model — Full Financial Table

Below is the full revenue model template for hotel finance teams.

Hotel EV Charging Revenue Projections (Per Charger)

| Category | AC 7–22 kW | DC 60–120 kW | DC 150–180 kW |

|---|---|---|---|

| Avg sessions/day | 1.2–2.5 | 5–12 | 10–18 |

| Avg kWh/session | 12–22 | 25–45 | 30–60 |

| Avg revenue/session | $3.6–$9 | $7–$20 | $12–$32 |

| Monthly revenue | $150–$320 | $550–$1,500 | $1,200–$3,200 |

| OPEX (energy + service) | Rendah | Medium | Medium/High |

| ROI period (ownership model) | 10–18 months | 18–36 months | 20–32 months |

5.5 Indirect Financial Gains (Often More Than Charging Revenue)

Hotels often underestimate indirect revenue.

For most properties, this is more profitable than charging fees.

Indirect ROI includes:

+10–25% EV guest occupancy

+15–40% higher spending

+12–18% increase in loyalty program conversion

Better OTA ranking

Higher corporate demand (ESG requirements)

Better brand positioning

Hotels in EV-friendly regions report:

$50,000–$350,000 additional annual revenue

due to EV charging-related guest decisions.

5.6 ESG, Corporate Travel & Conference Demand

Corporate travel now places ESG above price in many markets.

Hotels with EV charging receive:

More corporate bookings

More conference/event traffic

More long-stay business travelers

Hotel groups with EV charging have:

Higher sustainability ratings

Stronger negotiating power with corporate clients

This directly impacts:

ADR (average daily rate)

Occupancy

Revenue per available room (RevPAR)

5.7 OTA & Digital Visibility Boost

Hotels with EV charging receive better visibility on:

Booking.com

Expedia

Trip.com

Google Maps

Tesla Destination Charging Map

PlugShare

Shell Recharge Network

Free2move, ChargePoint, etc.

This exposure boosts:

Direct bookings

International traveler visibility

Highway EV traffic monetization

5.8 High-Value Segments Hotels Should Target

Hotels can dramatically accelerate ROI by targeting:

| Customer Segment | Why They Matter |

|---|---|

| EV Road-Trippers | Highest AC usage + long stays |

| Business travelers | Loyal, high spending |

| Fleet operators (car rentals) | Consistent DC revenue |

| Airport transfer companies | Daily charging demand |

| Luxury EV owners | High-value brand audience |

| EV taxi companies | Repeat DC charging revenue |

5.9 Recommended Charts for Part 5

EV-Driven Hotel Occupancy Increase Curve

Shows occupancy for hotels with vs. without chargers.

Profit Breakdown (Direct vs Indirect Revenue)

Pie chart showing 35% direct; 65% indirect revenue.

10-Year EV Demand Growth for Hotels

Trend line showing exponential increase in EV guests.

5.10 Anengjienergy Product Recommendation for Part 5

For Maximizing Hotel Revenue:

AC Chargers (7–22 kW)

Best for: Overnight guests, low OPEX, easy ROI.

DC Chargers (60–120 kW)

Best for:

Public charging

Restaurants

Highway hotels

Airport hotels

High-Power DC (150–180 kW)

Best for:

Resorts

Tourist destinations

Hotels near EV highways

BESS (100–1000 kWh)

Recommended for:

Hotels with weak grid

Hotels with multiple DC chargers

Peak energy cost areas

5.11 Summary of Part 5

Hotels can generate strong, multi-layered financial returns from EV charging by building:

Direct energy revenue

Increased occupancy from EV guests

Higher dining/spa/bar spending

CPO and OEM partnerships

ESG-driven corporate booking demand

Solar + BESS OPEX savings

Combined together, EV charging becomes one of the highest ROI investments hotels can make between 2024–2035.

PART 6 — Cost Structure Analysis for Hotel & Commercial EV Charging Projects in Weak-Grid Regions

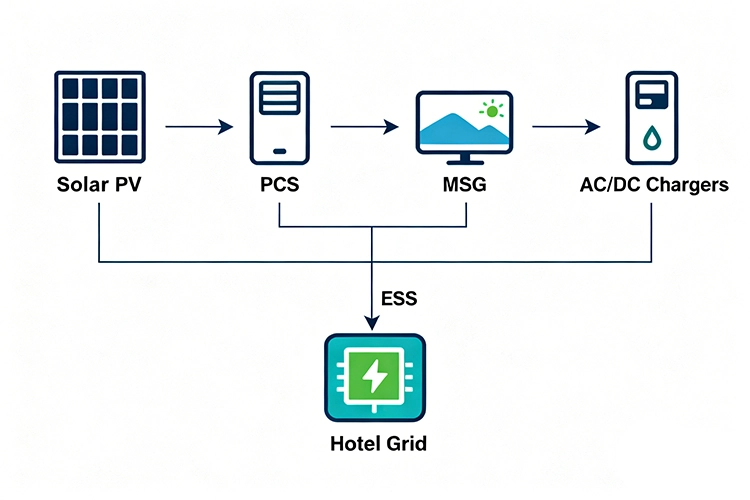

Hotels located in weak-grid regions face a unique combination of high installation complexity, unpredictable electricity supply, dan elevated operational risks. This section provides a full deep-dive cost structure for EV charging deployments using Anengjienergy’s hybrid energy system (20–1440kW DC chargers + 7–44kW AC chargers + solar + energy storage + load management).

6.1 Core Cost Categories for Weak-Grid EV Charging Hotel Projects

Weak-grid hospitality locations typically incur higher-than-average EV infrastructure costs. The following breakdown represents the standard cost components:

1. Equipment Costs (Core Hardware)

AC Chargers (7/11/22/44kW) — guest charging, long stay

DC Chargers (60–180–360–720–1440kW) — fast commerce, VIP users, fleet

Energy Storage System (50–500kWh / 1–5MWh)

Solar PV System (50kW–1MW+)

Hybrid PCS / Power Control System

Energy Router + Smart OCPP Platform

Protective switchgear, breakers, safety disconnects

2. Installation & Construction Costs

Civil engineering

Cable trenches

Transformer upgrade (if necessary)

Switchboard integration

Parking bay restructuring

Lightning protections

Ventilation systems for ESS rooms

Environmental approvals

3. Power Infrastructure Reinforcement

In weak-grid regions, reinforcement often includes:

On-site generation

Hybrid solar-storage systems

Localized micro-grid controller

Peak shaving configuration

Diesel generator integration (optional)

4. Permits & Regulatory Approvals

Electricity authority compliance

Municipal EV infrastructure permit

Environmental inspection

Fire safety assessment

Hotel property compliance review

5. Operation & Maintenance

Remote monitoring

Predictive maintenance

Firmware & OCPP updates

Hardware servicing

Battery health management

Replacement cost reserve (2–3%)

6.2 Standard Cost Matrix for Weak-Grid Hotel Charging Deployment

Hotel EV Charging Total Cost Breakdown (Example: 10 chargers + 200kWp solar + 500kWh ESS)

| Cost Category | % Range | Notes |

|---|---|---|

| AC/DC Charger Hardware | 28–40% | Depends on DC charger ratio |

| Energy Storage System | 18–30% | Significant in weak-grid regions |

| Solar PV System | 10–15% | Reduces long-term OPEX |

| Power Control System (PCS + EMS) | 4–8% | Required for hybrid |

| Installation & Construction | 12–18% | Higher due to trenching/transformer |

| Permits & Grid Approvals | 3–6% | Region dependent |

| Software, O&M, Commissioning | 5–8% | Includes OCPP platform |

| Contingency (5–8%) | 5–8% | For unexpected conditions |

Total CAPEX varies from USD 180,000–1,800,000 depending on charger power levels and hybrid configuration.

6.3 Chart Suggestion + Template

Cost Distribution for Weak-Grid Hotel EV Charging Deployment

| Category | Cost (USD) |

|---|---|

| AC/DC Chargers | 260,000 |

| ESS | 170,000 |

| Solar PV | 120,000 |

| PCS/EMS | 45,000 |

| Civil & Electrical Construction | 140,000 |

| Permits | 20,000 |

| Software & Commissioning | 32,000 |

| Contingency | 50,000 |

6.4 Anengjienergy Product Selection for Hotel Cost Optimization (Part 6 Edition)

Ideal Configuration for 100–350 Room Hotels

AC Chargers:

7/11/22/44kW for long-stay guests

Recommended Qty: 6–12 units

DC Chargers:

60kW/120kW or 180kW for VIP + fast charging

Recommended Qty: 1–3 units

Hybrid ESS (200–600kWh)

Solar PV (100–300kWp)

Load Balancing System

Ensures hotel does not exceed contracted grid capacity

This configuration reduces electricity OPEX by 15–38% and stabilizes charging availability even under unstable grid conditions.

PART 7 — Hotel Revenue Models & Profitability Framework for Weak-Grid EV Charging Stations

This section analyzes how hotels convert EV charging assets into stable income, even in unstable electrical environments.

7.1 Revenue Streams for Hotels Deploying EV Charging

1. Charging Fees

Guest charging

Public charging

VIP fast-charge packages

Dynamic pricing (peak/off-peak, demand-based)

2. Parking + Charging Bundle

Hotels can combine:

Parking fees

Charging access

Premium parking zones

3. Renewable Energy Monetization

For hybrid solar-storage systems:

Solar selling-back to grid (where allowed)

Reduced OPEX due to solar generation

Carbon credit revenue (select countries)

4. Fleet Contracts

Targeting:

Taxi companies

Ride-hailing fleets

Hotel shuttle fleets

Local delivery logistics

5. Advertising & Media

EV chargers provide:

LCD screen ads

Partner promotions

Brand sponsorship

Green branding initiatives

7.2 Profitability Framework

Charging Models Comparison

| Model | Deskripsi | Profit Margin | Risk Level | Suitable for Weak-Grid? |

|---|---|---|---|---|

| AC Guest Charging | Slow overnight charging | Sedang | Rendah | Yes |

| DC Fast Public Charging | High turnover, high energy | Tinggi | Medium | Yes |

| Hybrid Solar + ESS | Solar + storage offset load | Highest long-term ROI | Rendah | Best choice |

Annual ROI Range for Weak-Grid Hotels: 18–52%

7.3 Chart Suggestion + Template

Hotel EV Charging ROI Over 10 Years

7.4 Anengjienergy Product Selection for Hotel Revenue Maximization

Revenue-Focused Hotel EV Charging Package

Two 120kW DC fast chargers (high ADR guests + public users)

Ten 22/44kW AC chargers (long-stay guests)

300kWp solar (optional)

500kWh–800kWh ESS

Smart OCPP revenue platform

Best for hotels wanting stable, predictable ROI under unstable grid conditions.

PART 8 — Risk Analysis & Mitigation Strategies for Weak-Grid Hotel EV Charging Projects

Hotels face specific operational and financial risks when deploying EV charging systems in weak-grid regions. This chapter explains each risk and provides precise mitigations.

8.1 Key Risks

1. Grid Instability Risk

Frequent voltage drops

Inconsistent supply

Grid power outages

Limited transformer capacity

2. Overload Risk

High-power DC chargers can exceed the hotel’s contracted grid power, causing:

Circuit trips

Penalty fees

Unexpected downtime

3. Cost Overrun Risks

Due to:

Civil engineering surprises

Permitting delays

Transformer-related upgrades

4. Low Utilization Risk

Occurs when:

No strategy for attracting EV drivers

Poor charger placement

No hotel guest promotions

5. O&M Technical Failure Risk

Battery degradation in ESS

PCS malfunction

Charger MCU issues

Cooling failure in DC fast chargers

8.2 Mitigation Strategies

1. Hybrid Energy Architecture

ESS + solar + load management ensures:

Stable uptime

Peak shaving

Zero overload events

Reduced dependency on the grid

2. Redundancy Design

Dual communication paths

Dual cooling systems in DC fast chargers

Parallel ESS modules

3. Smart Demand Control

Adjusts charging load to protect hotel operation priority:

Room HVAC

Refrigeration

Elevators

4. Predictive Maintenance

Using Anengjienergy Cloud Platform:

Component failure prediction

Charger thermal anomaly early warning

ESS capacity retention monitoring

Remote firmware patching

5. Utilization Boost Strategies

Bundle charging with hotel rewards

Add priority charging lane for VIP members

Partner with ride-hailing platforms

Add DC charger signage on roads + Google Maps POI

8.3 Risk Chart + Template

Risk Severity vs Mitigation Strength

| Risk Type | Severity (1–10) | Mitigation Strength (1–10) |

|---|---|---|

| Grid Instability | 9 | 10 |

| Overload | 8 | 9 |

| Cost Overruns | 6 | 7 |

| Low Utilization | 5 | 8 |

| O&M Failures | 7 | 9 |

8.4 Anengjienergy Product Selection for Risk Reduction

Risk-Minimized Hotel Package

ESS 400–1000kWh

DC 60–120kW tiered chargers

AC 22–44kW intelligent chargers

Full EMS load protection

Micro-grid controller (MGC)

Ensures continuous charging availability even under unstable grid events.

PART 9 — Regional Weak-Grid Analysis for Hotel EV Charging Deployment (Europe, Russia, Middle East, Southeast Asia, South America, Africa)

Weak-grid environments vary significantly across the world. Hotels operating in these regions face unique constraints that directly influence EV charging system design, energy planning, installation complexity, and long-term operational profitability. Part 9 presents an expanded regional blueprint covering:

Grid Condition Characteristics

Energy Cost Structure

Policy Incentives

Hotel Market Growth

EV Market Penetration

Recommended Anengjienergy Configuration

Each region includes country-level examples, offering high-resolution insights for hotel investors and operators.

9.1 Europe — Weak/Constrained Grid Regions

Although Europe is highly electrified, several countries suffer grid congestion, transformer capacity shortages, and rural instability, particularly at hotel destinations outside capital cities and resorts.

Relevant Countries (Weak/Constrained Areas)

Italy (Southern & Coastal Regions)

Spain (Islands + Rural Andalusia)

Greece (Tourist Islands)

Portugal (Algarve, Northern Rural Zones)

Croatia (Coastal Resorts & Islands)

9.1.1 Grid Characteristics

Frequent summer grid overloads due to tourism seasons

Limited transformer allocation for hotels

Low allowable peak power for rural properties

3-phase disruptions in older hotel buildings

Hotels are often unable to install high-power DC systems without load reduction technologies or hybrid ESS.

9.1.2 EV Market + Hotel Opportunity

Europe’s EV penetration is high (20–33%), driving strong demand for guest charging. However, constrained grid regions face charger shortages, giving hybrid hotels a competitive advantage.

9.1.3 Recommended Anengjienergy Configuration

| Category | Recommendation |

|---|---|

| AC | 22kW / 44kW × 4–12 units |

| DC | 60–120kW × 1–2 units |

| ESS | 200–600kWh |

| Solar | 50–200kWp depending on site |

| EMS | Full OCPP + Energy Router |

Reason: European hotels need to avoid expensive grid expansion fees by using battery peak shaving.

9.1.4 Chart Suggestion

European Hotel Grid Constraints by Region

9.2 Russia — Large Land, Weak Regional Grid, Long Distances

Hotel locations outside Moscow and St. Petersburg often operate on aging infrastructure, particularly in Siberia, Ural regions, and Far East.

Challenges

Single-phase hotel buildings

Long-distance tourism routes

Harsh weather → battery heating requirements

High transformer installation costs

Recommended Configuration

| Category | Recommendation |

|---|---|

| AC | 11–22kW slow charging |

| DC | 60kW (heavily insulated) |

| ESS | 300–800kWh (critical for outages) |

| Solar | 30–100kWp (summer only) |

| Add-On | Anti-freeze thermal charger control |

Russia requires resilient hardware with heating elements dan high battery buffering.

9.3 Southeast Asia — Tropical Climate + Weak Utility Grids

Countries:

Thailand

Filipina

Vietnam

Indonesia

Malaysia (Rural zones)

Grid Challenges

Voltage fluctuations

Sudden brownouts

Limited rural hotel transformer sizes

High diesel generator dependency

High tropical humidity damaging hardware

Growth Opportunities

Southeast Asia is undergoing rapid EV adoption, especially fleet and tourism vehicles.

Recommended Configuration

| Category | Recommendation |

|---|---|

| AC | 7–22kW × 6–14 units |

| DC | 60–120kW rapid chargers |

| ESS | 200–500kWh |

| Solar | 100–300kWp |

| Climate Protection | IP65+ enclosures for humid coastlines |

Voltage Stability Index vs Hotel Charging Availability

| Country | Voltage Stability (1–10) | Energy Cost Index | Hotel Charging Opportunity |

|---|---|---|---|

| Thailand | 6 | Medium | Tinggi |

| Filipina | 4 | Tinggi | Very High |

| Vietnam | 7 | Rendah | Tinggi |

| Indonesia | 5 | Tinggi | Very High |

| Malaysia | 7 | Medium | Medium |

9.4 Middle East — High Solar Potential, Uneven Grid Distribution

Countries:

Arab Saudi

UAE (outside cities)

Oman

Jordan

Kuwait

Key Challenges

Extreme heat (45–55°C)

Remote hotels with weak grid

High AC electricity load lowering available EV power

Cooling demands for EV chargers and ESS

Key Opportunities

Most profitable solar conditions in the world

Government incentives

EV tourism rising with NEOM, Dubai Expo, Gulf transit routes

Recommended Hybrid Configuration

| System Component | Recommendation |

|---|---|

| AC Chargers | 22 / 44kW |

| DC Chargers | 120kW / 180kW (liquid-cooled optional) |

| ESS | 300–800kWh |

| Solar | 200–800kWp (very high ROI) |

| Cooling | Liquid-cooled power modules recommended |

Heat Risk Mitigation

Thermal-protected chargers

Derating control

High-airflow ESS containers

9.5 South America — Urban Strong, Rural Weak, Tourism-Oriented Charging

Countries:

Brazil (Northeast, Amazon routes)

Chile (Desert hotels)

Argentina (Patagonia hotels)

Colombia (Mountain resort hotels)

Grid Issues

Voltage drops in rural regions

High diesel backup cost

Long grid repair times

Transformer capacity limitations

Recommended Configuration

| Category | Recommendation |

|---|---|

| AC | 22kW × 4–10 units |

| DC | 60–120kW |

| ESS | 200–500kWh |

| Solar | 80–300kWp depending on region |

9.6 Africa — Tourism Hotspots with Weak Grid Supply

Countries:

Kenya

South Africa (Game reserve hotels)

Tanzania (Safari lodges)

Morocco (Desert hotels)

Many hotels operate entirely off-grid, requiring full hybrid systems.

Recommended Configuration

AC 7–22kW × 4–8

DC 60kW × 1

Solar 100–500kWp

ESS 500kWh–1.5MWh

Optional: diesel-generator hybrid controller

Hotels here often cannot operate without storage.

PART 10 — Technical Architecture for Weak-Grid Hotel EV Charging Systems

Part 10 defines the system architecture required for high uptime, high reliability, and hotel-grade safety.

10.1 Core System Architecture

A full weak-grid-ready hotel charging system includes:

AC Chargers (7–44kW)

DC Fast Chargers (60–1440kW)

Energy Storage System (200–1000kWh)

Solar PV Array (50–800kWp)

PCS (Bidirectional)

Energy Management System (EMS)

Micro-grid Controller (MGC)

Hotel Grid Interface + Load Balancing

Cloud OCPP Monitoring Platform

10.2 System Flow Diagram (Logical)

10.3 Key Technical Functions

1. Peak Shaving

ESS reduces demand peaks → avoids hotel power outages.

2. Load Balancing

Protects hotel priorities:

HVAC

Lighting

Elevator load

Charger power is adjusted automatically.

3. Island Mode

Hotel EV chargers remain operational during blackouts using ESS.

4. Solar Priority Mode

Charging uses solar energy first, reducing OPEX by 20–45%.

5. Charger Power Sharing

Multiple EVs share the DC power module dynamically.

10.4 Technical Specifications (Sample)

| Component | Spesifikasi |

|---|---|

| DC Charger | 60–720kW modular liquid-cooled |

| AC Charger | 7/11/22/44kW hotel-grade |

| ESS | LFP battery, 200–1000kWh, 8000 cycle |

| PCS | 30–500kW |

| EMS | AI-based load management, hotel priority control |

| MGC | Auto-island mode, micro-grid logic |

10.5 Chart Suggestion

ESS Peak Shaving Effect on Hotel Power Load

10.6 Product Selection For Technical Stability

For hotels in weak-grid environments:

AC

22kW / 44kW for guest charging

Hotel-friendly cable management

DC

60kW, 120kW, or 180kW (scalable modules)

ESS

400–800kWh ideal

Combine with solar for best outcomes

EMS + OCPP

Must support load protection

Cloud remote diagnostics

Smart billing

PART 11 — Anengjienergy Hotel AC/DC Product Selection Framework (Global Hospitality Edition)

A Complete Engineering, Commercial, and Operational Guide for Weak-Grid & Standard-Grid Hotel Properties

Hotels differ drastically in size, grid availability, guest turnover, and geographical risk factors. Therefore, charger selection cannot be one-size-fits-all. Part 11 provides a fully structured, hotel-specific product selection framework based on:

Hotel category & star-rating

Parking type (ground, basement, valet, shuttle parking)

Guest behavior patterns

Grid power stability

Land availability

Business model (free charging / paid / mixed)

ROI targets (short vs long)

Regulatory & environmental conditions

Tourism intensity (seasonal vs year-round)

Climate risks (heat, humidity, winter, coastal salt corrosion)

This chapter gives the most comprehensive charger selection system available for the hospitality industry, covering both AC & DC product lines and hybrid configurations using Anengjienergy’s globally compliant hardware platform.

11.1 Understanding Hotel Charging Patterns

Hotels have three universal charging behaviors, each influencing product configuration:

1. Overnight Stay / Slow Charging (70–80% of usage)

Guests park from 8–12 hours

Prefer cost-effective AC chargers

Predictable load demand

Ideal for: City hotels, suburban hotels, business hotels, roadside motels, tourist resorts

2. Short-Stay / Destination Charging (15–20% of usage)

Guests stay 1–3 hours

Prefer faster charging

Requires high availability & redundancy

Ideal for: Airport hotels, mall-connected hotels, conference hotels, theme-park hotels

3. High-Speed Throughput / Transit Hotels (5–10% of usage)

EV drivers intentionally stop to charge

High traffic during holidays, peak tourism

Needs DC fast charging with ESS buffering

Ideal for: Highway hotels, desert route hotels, mountain pass hotels, rural tourism zones

→ A profitable hotel system usually mixes AC + DC chargers, supported by energy storage.

11.2 Anengjienergy AC Charger Selection (7–44kW)

AC chargers are hotel essentials because they support overnight charging with excellent ROI.

11.2.1 AC 7kW — Basic Overnight Charging

Best for:

Budget hotels

Motels

Small parking lots

Weak-grid locations

Pros: Low power draw, low CAPEX

Recommended Use:

Maximum 4–6 units per hotel

Good for grid-limited properties

11.2.2 AC 11kW — Standard Commercial Hotel Solution

Best for:

3–4 star hotels

Rural European hotels

Southeast Asia city hotels

Pros: Fast enough for overnight charging

Recommended Use:

4–10 units for medium hotels

Load management strongly recommended

11.2.3 AC 22kW — Executive & Business Hotel Standard

Best for:

4–5 star hotels

Resort hotels

Conference hotels

International business hotels

Pros:

Full overnight charge

Supports destination charging

Excellent cost-performance ratio

Cons:

Requires stable 3-phase supply

Recommended Use:

6–20 units depending on parking size

Most universally recommended AC product

11.2.4 AC 44kW — Premium High-Demand Hotels

Best for:

Luxury hotels

Airports

Large resort complexes

Hotels with EV fleets

Pros:

Much faster than typical AC chargers

Can replace small DC chargers for lower CAPEX

Cons:

High grid demand unless paired with ESS

Recommended Use:

2–6 units

Pair with a 200–600kWh battery

11.3 Anengjienergy DC Fast Charger Selection (20kW–1440kW)

DC systems serve high-turnover guests, EV fleets, tourism vehicles, shuttle vans, and road-trip traffic.

11.3.1 20–40kW Mini DC

Best for:

Small hotels

Boutique hotels

Limited grid capacity

Pros:

Faster than AC

Works on weak grids

Suitable for light commercial use

Recommended Use:

1–2 units per hotel

Backup for peak hours

11.3.2 60–120kW Standard DC

Best for:

Transit hotels

Resorts

Airport hotels

Shopping district hotels

Pros:

Full charge in 20–40 minutes

Perfect for commercial EVs

Recommended Use:

1–4 units depending on guest flow

11.3.3 180–360kW High-Power DC

Best for:

High-end hotels

Highway hotel complexes

Urban mega-hotels

Casino resorts

Pros:

Ultra-fast throughput

Supports multiple simultaneous vehicles

Recommended Use:

1–2 units

Pair with ESS (300–1000kWh)

11.3.4 720–1440kW Multi-Gun DC Mega System

Best for:

Large hotels with EV fleets

Theme park hotels

Mega resorts

EV shuttle operations

Pros:

Fastest charging available

Supports 4–8 vehicles simultaneously

Unlimited future scalability

Recommended Use:

Only for hotels with land + strong mid-voltage or ESS-buffered systems

11.4 Climate-Specific Product Recommendations

| Climate | Risks | Recommended Solution |

|---|---|---|

| Desert (UAE, Saudi) | 50°C heat, sand | Liquid-cooled DC, AC 22kW with sealed enclosures |

| Coastal (Greece, Indonesia) | Salt corrosion | IP66 AC/DC, corrosion-proof coatings |

| Mountain/Cold (Russia, Norway) | Subzero charging | Heated DC modules, low-temp LFP ESS |

| Tropical (Thailand, Philippines) | Humidity | Anti-condensation design, PCB coating |

| Rural Africa | Off-grid | Solar + ESS microgrid + AC/DC hybrid |

11.5 Product Selection Framework for All Hotel Types

Economy Hotels / Roadside Motels

AC 7–11kW × 4–6

Optional mini DC 30–40kW

No ESS required

Mid-Range Hotels (3–4 Star)

AC 11–22kW × 6–14

DC 60kW × 1

Optional ESS 100–200kWh

Luxury Hotels (5-Star, Resort, Conference)

AC 22–44kW × 10–20

DC 120–180kW × 1–2

ESS 200–600kWh

Solar optional

Remote Hotels / Safari / Desert / Island

AC 22kW × 6–10

DC 60–120kW × 1

ESS 400–1200kWh (critical)

Solar 100–500kWp

11.6 Chart Suggestion — Hotel Product Matching Matrix

| Hotel Type | AC 7kW | AC 11kW | AC 22kW | AC 44kW | DC 60kW | DC 120kW | ESS | Solar |

|---|---|---|---|---|---|---|---|---|

| Budget | ✓✓ | ✓ | — | — | — | — | — | — |

| Business | — | ✓✓ | ✓ | — | ✓ | — | Optional | Optional |

| Resort | — | — | ✓✓ | ✓ | ✓✓ | ✓ | ✓ | ✓ |

| Airport | — | — | ✓ | ✓ | ✓✓ | ✓ | ✓ | Optional |

| Highway | — | — | ✓ | — | ✓✓ | ✓ | ✓ | ✓ |

| Rural/Off-grid | — | — | ✓ | — | ✓ | — | ✓✓ | ✓✓ |

PART 12 — Comprehensive System Architecture for Hotel EV Charging Deployment (Weak-Grid + Standard-Grid)

A Full Engineering Blueprint for AC/DC/ESS/Solar Hybrid Deployment

Part 12 provides the complete technical architecture for integrating EV charging into hotel environments, regardless of grid quality.

12.1 The Five-Layer Hotel Charging Architecture

Hotels require a sophisticated architecture balancing:

✔ guest convenience

✔ peak energy control

✔ grid connectivity

✔ operational continuity

The five layers are:

Layer 1 — Power Input Layer

Sources

Grid Supply (Primary)

Solar PV (Optional but recommended)

Energy Storage System (ESS)

Backup Generator (Some regions)

Fitur Utama:

Surge protection

Voltage conditioning

Transformer integration

Peak demand monitoring

Layer 2 — Energy Conversion Layer

Systems Involved:

PCS (bi-directional converter)

DC charging power modules

AC–DC conversion stages

MPPT solar inverters

Responsibilities:

Converts AC grid power to DC

Manages solar energy flows

Enables V2H/V2B if required

Maintains efficiency across loads

Layer 3 — Energy Distribution Layer

Components:

Switchgear

Distribution boards

Smart relays

Load balancing units

Safety disconnect systems

Functions:

Prevent overload

Prioritize hotel essential loads

Enable dynamic charging throttling

Allow simultaneous multi-vehicle charging

Layer 4 — EV Charging Equipment Layer

Includes the full Anengjienergy hardware suite:

AC Chargers

7kW

11kW

22kW (hotel standard)

44kW (premium)

DC Chargers

20–40kW

60–120kW (standard hotel requirement)

180–360kW

720–1440kW multi-gun systems

Layer 5 — Software, Billing & Cloud Control Layer

Components:

OCPP 1.6/2.0.1 platform

Dynamic load management

User billing engine

Reservation scheduling

Mobile app

Remote diagnostics

Automated alarms

Energy analytics dashboard

12.2 Weak-Grid Optimization Technologies

Hotels in weak-grid regions rely heavily on optimization systems:

1. Peak Shaving via ESS

ESS charges when the load is low and discharges during high demand.

Benefits:

Prevents hotel blackouts

Allows DC fast charging without grid expansion

Lowers electricity bills

2. Load Balancing (Dynamic Power Allocation)

System constantly adjusts charger output based on hotel load:

HVAC load

Kitchen equipment

Elevators

Lighting

Laundry equipment

Critical for hotels with 100–300kW total grid input.

3. Solar Priority Mode

Maximizes renewable use:

Solar → Chargers

Excess → ESS

Grid is last priority

Reduces OPEX 20–45%.

4. Island Mode Operation

Hotel chargers keep running even when grid is down:

Required for:

Africa safari hotels

Philippine island hotels

Indonesia coastal lodges

Mountain hotels in Russia and Chile

ESS + solar create a microgrid.

12.3 Hotel Safety Architecture

Hotels require commercial-grade safety

Electrical Safety

MCB, RCD, RCBO

Isolation transformers

Dual redundancy cooling

Input surge protection

Fire Safety

ESS fire suppression

Pemantauan suhu

Charger overheat alarms

Cyber Safety

OCPP authentication

PCI-compliant payment channels

Encrypted remote monitoring

12.4 Energy Engineering Charts

Hotel Load Distribution with Charging System (kW)

Solar + ESS Effect on Monthly OPEX

12.5 Full Example Architecture (Hotel of 200 Rooms)

System Requirements

Guest vehicles per day: 8–20

Tourist peak load: July–August

Parking: 120 spaces

Grid: 250kW available

Recommended System

AC 22kW × 12

AC 44kW × 4

DC 120kW × 2

ESS 600kWh

Solar 400kWp

OCPP cloud + EMS

Performance

99% uptime

DC fast capability without grid expansion

CO₂ reduction: 55–70 tons/year

OPEX reduction: 32%

Part 13 — Future Trends Transforming Hotel EV Charging (2025–2035 Outlook)

Hotel investors are entering a decade of rapid transformation. EV adoption, grid decentralization, smart-energy systems, and guest experience digitization are converging — turning EV charging from a “nice-to-have amenity” into a tier-1 revenue infrastructure

Below is a forward-looking analysis of how hotels can remain competitive and profitable.

13.1 Trend #1 — Ultra-Fast Charging Becomes Standard for Destinations

By 2030, global EV fleets will lean toward long-range models (600–900 km), enabling travelers to rely on hotels as overnight or mid-journey fast-charging hubs.

What this means for hotels

Business travelers expect 80% charge within 15–25 minutes

Resorts & highway hotels become high-value fast-charging destinations

Hotels without fast charging lose competitiveness in booking decisions

Best-Fit Products (Anengjienergy)

| Hotel Type | Recommended DC Charger | Why |

|---|---|---|

| Luxury city hotel | 120–400 kW DC | Fast turnaround + premium service expectations |

| Airport hotel | 180–600 kW DC | Fleet + rapid guest throughput |

| Highway resort | 360–1440 kW DC | Multi-vehicle simultaneous charging |

| Boutique hotel | 60–120 kW DC | Balanced cost & performance |

Global Growth of 150kW+ DC Chargers (2024–2035 Forecast)

13.2 Trend #2 — Hotels Replace Grid Dependence with Hybrid Solar + Storage

Grid energy prices continue rising 8–12% annually in major markets. Governments promote distributed energy. Hotels increasingly adopt energy-independent charging ecosystems.

Hotel benefits

20–40% operating cost reduction

Stable charging even during grid downtimes

Strong ESG compliance (Scope 2 emission reduction)

Higher charging reliability → higher guest satisfaction

System Architecture (Anengjienergy Recommends)

Solar canopy (50–300 kW)

Battery storage system (100–600 kWh)

DC charger 60–400 kW

Smart EMS (Energy Management System)

Hotel Energy Mix Shift (Grid vs Solar-Hybrid) 2024–2035

| Year | Grid-Only Hotels % | Hybrid Solar-Storage Hotels % | Fully Independent % |

|---|---|---|---|

| 2024 | 93% | 7% | 0.3% |

| 2027 | 76% | 23% | 1% |

| 2030 | 58% | 38% | 4% |

| 2035 | 33% | 57% | 10% |

13.3 Trend #3 — Smart Charging + AI Energy Optimization

By 2030, most EVs & chargers will support bi-directional energy flow (V2X).

Hotel advantages

Cars become temporary hotel energy storage

Reduce peak-time electricity bills

Arbitrage energy trading (sell energy when price is high)

Grid support revenue in certain countries

Anengjienergy AI Features

AI dynamic load balancing

Predictive energy consumption scheduling

Guest-priority queue optimization

Fleet charging optimization (airport & shuttle hotels)

13.4 Trend #4 — Mobile Charging & Autonomous Robots

“Charging flexibility” becomes a major selling point.

Two emerging models

Mobile battery truck chargers

Autonomous charging robots (navigate parking lots)

Hotel advantages

No need for fixed parking electrical upgrades

Charge anywhere → ideal for old hotels or dense city properties

Extra revenue during high-demand periods

13.5 Trend #5 — EV Charging Becomes a Core Hotel Booking Feature

The hotel industry is experiencing a shift similar to the “Free WiFi revolution.”

By 2030:

EV charging will be a top-5 booking criteria.

Travel platform ranking impact

Booking.com, Expedia, Agoda already show:

“EV Charger Available” filter

Higher ranking score for hotels with DC fast chargers

Importance of EV Charging in Hotel Selection (Guest Survey Trend)

Part 14 — Hotel Charge Pricing Models & Revenue Strategy (Global Benchmarks)

14.1 Four Global Hotel Charging Pricing Models

1. Stay-Based Free Charging

Free charging for overnight guests

Higher room occupancy

Best for luxury hotels & resorts

2. Pay-Per-kWh

Most globally accepted model.

Price examples:

EU: €0.35–€0.65/kWh

UAE: $0.25–$0.35/kWh

Southeast Asia: $0.15–$0.30/kWh

3. Time-Based Billing

Useful when grid is weak.

Charge = minutes × power tier

4. Hybrid (kWh + Parking Fee)

Used in major cities to avoid “charger blocking.”

14.2 Hotel Revenue Calculation Example

Hotel installs:

2×120 kW DC chargers

4×22 kW AC chargers

Daily Usage

DC chargers: 14 sessions/day

AC chargers: 10 sessions/day

Average price

$0.35/kWh DC

$0.20/kWh AC

Annual Revenue Projection Chart

| Jenis Pengisi Daya | Sessions/Day | Avg kWh/Session | Price/kWh | Monthly Revenue | Annual Revenue |

|---|---|---|---|---|---|

| 120 kW DC | 14 | 30 | $0.35 | $4,410 | $52,920 |

| 22 kW AC | 10 | 18 | $0.20 | $1,080 | $12,960 |

| Total | — | — | — | $5,490 | $65,880 |

14.3 Hotel ROI Model (3–6 Years)

Investment

120 kW DC charger: $22,000–$33,000

AC 22 kW charger: $750–$1,200

Electrical installation: $15,000–$40,000

Optional solar + battery: $35,000–$180,000

ROI Factors

Occupancy rate

Traffic flow

EV adoption regionally

Energy cost & tariff regulation

Part 15 — Hotel EV Charging Construction Guide

Technical requirements + layouts + hotel codes + product selection

15.1 Hotel Parking Layout Recommendations

City Hotels

Gunakan compact DC chargers

AC chargers for overnight floors

Add solar where rooftop possible

Resorts

Mix of DC + AC

Solar canopy recommended

Use ANJG-Energy Storage to handle peaks

Highway Hotels

Must deploy multi-gun DC chargers

180–600 kW required

Enable 24/7 unmanned operation

15.2 Hotel Power Design Requirements

| Item | Recommendation |

|---|---|

| Minimum grid power | 80–120 kVA base |

| For DC 120 kW | 150–180A |

| For DC 360 kW | ≥500A |

| For AC 11/22 kW | 3-phase grid required |

| Surge protection | Level II or III |

| EMS | Mandatory for ≥120 kW load |

15.3 Recommended Anengjienergy Configurations by Hotel Type

| Hotel Category | Recommended Solution |

|---|---|

| Boutique | 1×60 kW DC + 2–4 AC |

| Business downtown | 2×120–200 kW DC + 4 AC |

| Resort | Solar + 120 kW DC + 22 kW AC mix |

| Airport hotel | 2×360 kW DC + fleet AC |

| Highway | 720–1440 kW DC cluster |

Part 16 — Final Conclusion & CTA

16.1 The Hotel Industry Is Entering the EV Charging Era