As the electric vehicle (EV) market continues to expand in Australia and the broader Oceania region, there is a growing demand for reliable and efficient charging infrastructure. New EV charging station operators need quick access to advanced technology, reliable maintenance, and scalability to compete in this rapidly evolving market.

Why Tritium collapsed — risks, failures, and lessons

What happened to Tritium

Tritium declared insolvency in April 2024; its Australian entities filed for voluntary administration. Evcandi+2赫伯特·史密斯·弗里希尔斯+2

In August 2024, Exicom acquired Tritium’s assets (Tennessee factory, Brisbane engineering center, global business footprint) for a fraction of earlier valuations. Canary Media+2Exicom+2

Once valued near US $2 billion after its 2022 Nasdaq listing, Tritium’s market value collapsed to near zero in less than two years. The Runway Ventures+2维基百科+2

Many industry observers have analyzed the fall, and a range of structural and strategic problems emerge.

Key problems / structural issues

From public sources, major issues that plagued Tritium:

| Issue | Description / Evidence |

|---|---|

| Over‑expansion & cash burn | Building a U.S. manufacturing plant (Tennessee) while keeping the Australian facility open incurred heavy costs — capital and operating — without corresponding timely revenue. The Runway Ventures+2维基百科+2 |

| Weak profitability & high losses | By 2023, despite reported revenue (e.g. US $185M), Tritium showed net losses of ~US $120M, with cash outflows and net liabilities mounting. The Runway Ventures+2Evcandi+2 |

| Reliability & product quality issues | Some early 50 kW chargers reportedly had reliability problems, hurting reputation and increasing warranty / maintenance costs. The Runway Ventures+1 |

| Dependence on public funding and large contracts | Without consistent government support or sustainable business model shifting to lower‑margin segments (e.g. home or destination charging), cash flow was unstable. The Runway Ventures+1 |

| High fixed cost base and inventory obligations | Global deployment across 47+ countries, with logistics, support, and inventory obligations, but limited operating margins. 维基百科+1 |

These systemic problems — high cash burn, weak profitability, reliability issues, and over‑stretching globally — eventually overwhelmed the company when capital dried up and market pressure increased.

Hence, despite technological leadership and large orders, Tritium’s business model proved unsustainable under economic stress — culminating in insolvency and acquisition.

What Tritium’s collapse reveals to the market — and what it lacks now

From the public record:

Charger supply reliability may be disrupted during transition; maintenance support may be uncertain. Canary Media+1

Customers may face long wait times for spare parts or warranty services, especially in Australia / APAC, given reorganization under new ownership.

Confidence in DC fast‑charging deployment may be shaken; investors, fleet operators, or charging network owners may become more cautious.

In short: there is a clear gap — a reliability gap, a service support gap, and a business‑model clarity gap. That gap creates an opening for more robust, well‑structured, financially prudent charging‑station suppliers to fill.

This is where Anengjienergy’s value proposition — if well communicated — can gain traction, especially in Australia, New Zealand and broader Oceania where EV demand is rising but infrastructure stability remains crucial.

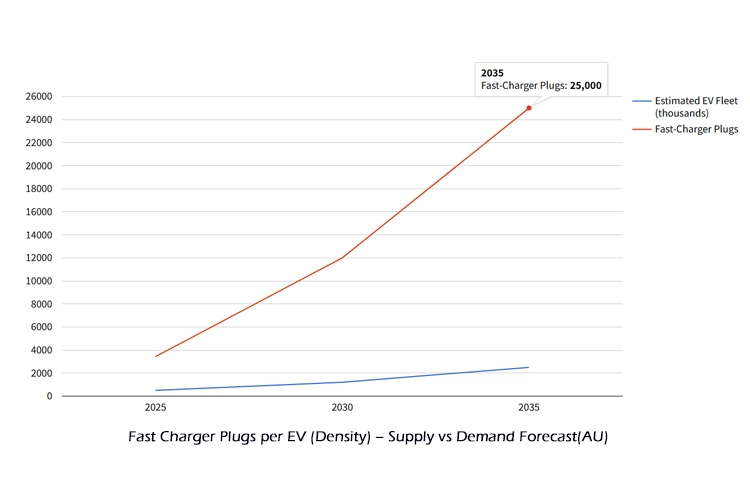

Public Fast Charging Sites(Data and Forecast)

Why Anengjienergy is well-positioned to respond — strengths & competitive advantages

Here’s how Anengjienergy addresses not just the technical needs of DC fast charging, but also the structural weaknesses that sank Tritium.

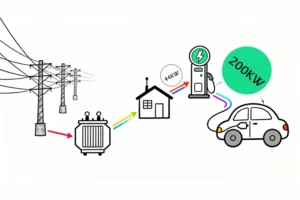

Balanced business model with hybrid energy systems

Anengjienergy not only produces fast DC chargers — but also offers solar + energy storage integration (ESS) and smart load‑management. This design reduces reliance on grid infrastructure and lowers OPEX, especially in regions with unstable grids or high electricity cost.

Because Anengjienergy’s offering includes battery storage and renewable integration, its charger deployments can be more grid‑agnostic, suitable for remote, rural, or less-developed regions — exactly the kind of places where public fast charging is scarce.

Scalable charger portfolio — from small to ultra-high power

Anengjienergy’s DC charger line covers a wide power range (from modest DC fast chargers up to high-capacity units), enabling deployment tailored to location: highway rest‑stops, urban charging hubs, fleet depots, or commercial centers.

This flexibility allows operators to match CAPEX, expected traffic volume, y grid capacity, rather than overbuild and risk under-utilization or financial strain (a mistake Tritium made).

Global standards and compliance — readiness for APAC & Oceania markets

Anengjienergy’s chargers meet international certifications (e.g., CE, CB, CQC, EAC), ensuring compliance with regulatory and safety standards globally. This makes it easier to deploy in markets like Australia, New Zealand, Pacific Islands, or southeast Asian countries without significant rework or certification delays.

For customers (commercial operators, fleet managers, governments) this compliance reduces risk and increases trust compared to a company with financial instability history.

Lower operational risk, better service & maintainability

By combining chargers with energy storage and optionally renewable energy sources, Anengjienergy helps reduce peak demand charges and ensures more stable service even in grid‑constrained areas.

This reduces long-term operating cost, which is a major concern for public charging networks, fleet depots, or highway charging stations.

Market timing: Filling the post‑Tritium gap in Australia / Oceania

With Tritium’s collapse and reorganization, many existing customers (charging networks, fleet operators) will be looking for a stable, reliable supplier for new rollouts or maintenance.

Anengjienergy can position itself as a new alternative — offering not just hardware, but a full energy‑system solution (charger + ESS + renewable integration) — which resonates better in markets with high grid costs or variable renewables (e.g. Australia).

Conclusion: A New Opportunity for EV Charging Operators in Oceania

With the fall of Tritium and the challenges facing legacy players in the DC fast charging market, Anengjienergy presents a robust, scalable, and reliable alternative. New charging station operators in Australia and the Oceania region can leverage Anengjienergy’s state-of-the-art EV charging solutions a rapidly deploy high-efficiency charging stations, provide reliable service, and ensure sustainable, future-proof infrastructure for the growing EV market.

As EV adoption continues to rise, Anengjienergy offers the tools, technology, and support needed to quickly capture market share, meet increasing demand, and build long-term profitability in the fast-charging infrastructure space.

For operators looking to enter the EV charging market, Anengjienergy is the partner you need to ensure successful, scalable, and reliable deployments.